Russia maintains oil production near OPEC+ target, but challenges remain

- Russia's oil production in February was slightly below its OPEC+ quota, but generally in compliance.

- OPEC+ will proceed with planned output increases, though these may be adjusted based on market conditions.

- Russia faces challenges with sanctions and drone attacks, affecting oil exports and refining capacity.

Russia’s crude oil production in February remained nearly unchanged from January, staying just below its OPEC+ quota, Bloomberg reported on Thursday.

Last month, output averaged 8.964 million barrels per day, according to the report.

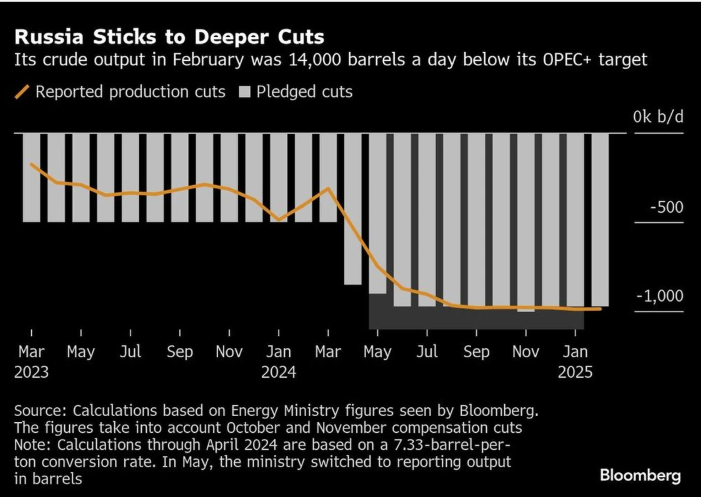

This figure falls 14,000 barrels per day short of Russia’s target under the OPEC+ supply agreement.

Russia, once lagging in its commitment to the production cuts agreed upon by the Organization of Petroleum Exporting Countries and its allied partners (OPEC+), has now rectified its position.

The country has affirmed that its crude oil production is now fully aligned with the terms of the agreement.

Russia’s pledge

Copy link to sectionAs part of its commitment to the OPEC+ alliance, Russia had pledged to curtail its crude oil output by 971,000 barrels per day.

This reduction was to be implemented based on a baseline production level of 9.949 million barrels per day.

Despite previous measures taken to stabilise the market, further production cuts are necessary to offset the effects of earlier overproduction.

Russia and its OPEC+ allies recently reaffirmed their commitment to implement these additional cuts by June.

This decision comes as part of a broader effort to rebalance the global oil market and address the lingering consequences of excess supply.

In line with this commitment, the OPEC+ alliance has set a deadline of March 17 for member countries to submit updated compensation plans to the OPEC secretariat.

These plans will outline the specific measures each country will take to achieve the agreed-upon production cuts and contribute to the overall market stability.

The decision by Russia and its OPEC+ allies to implement further production cuts reflects the ongoing challenges facing the global oil market.

While previous efforts have helped to mitigate some of the effects of overproduction, the market remains volatile and susceptible to fluctuations.

The March 17 deadline for submitting updated compensation plans underscores the urgency of the situation.

OPEC+ decision

Copy link to sectionEarlier this week, OPEC+ had agreed to go ahead with its initial plan of unwinding some of the 2.2 million barrels per day of crude oil voluntary production cuts from April.

This decision includes a production increase specifically granted to the United Arab Emirates.

As a result of these combined increases, the total oil production from OPEC+ countries is projected to rise by 138,000 barrels per day in the upcoming month.

However, OPEC+ said the production increases may be paused or reversed depending on market conditions.

OPEC+ had extended these cuts several times last year. The cuts are scheduled to expire at the end of March.

Experts had expected the cartel to once again extend these cuts beyond the end of March.

Zain Vawda, market analyst at OANDA, said in a note:

Some including myself thought they might delay this increase toward the second half of 2025 at the earliest. The move is likely to please President Trump, who has been pushing OPEC to raise output.

Russia classified output data

Copy link to sectionAfter Western sanctions were imposed on Russia’s energy sector due to the invasion of Ukraine, Russia classified its official oil production data.

This lack of transparency makes it difficult to independently verify output figures, leaving market watchers to rely on indicators such as seaborne exports and domestic refinery runs.

In January, the US blacklisted two major crude producers in Russia as well as tankers that ship oil abroad.

This was part of the most aggressive restrictions yet on Russia’s oil sector. Any transactions subject to these restrictions were given a grace period until the end of February.

Four weeks leading up to March 2 saw Russia’s seaborne crude oil shipments climb to their highest point since November, according to the report.

However, the volume of Russian barrels stored at sea also saw a significant rise, suggesting that Moscow is facing increasing difficulties in its oil trading operations.

Ukraine’s persistent drone attacks have diminished Russia’s refining capacity, as Kyiv seeks to limit Moscow’s ability to provide fuel for its military operations.

More industry news