North Carolina proposes Bitcoin Reserve Bill, aims to allocate 10% of public funds

- The bill includes provisions for multi-signature cold storage to ensure secure Bitcoin holdings.

- Monthly audits will be conducted to maintain transparency and provide proof of reserves.

- The legislation positions North Carolina as a potential leader in state-backed crypto investments.

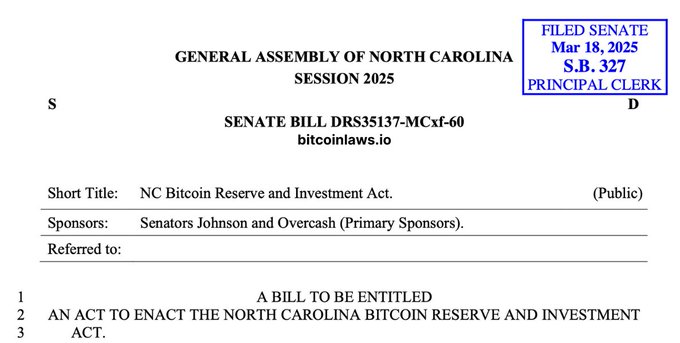

North Carolina is making a bold move into cryptocurrency with the introduction of the Bitcoin Reserve and Investment Act (SB327).

If passed, the bill would allow the state to allocate up to 10% of its public funds into Bitcoin.

NEW: North Carolina Bitcoin Reserve Bill SB327 authorizes the State Treasurer to allocate up to 10% of public funds to Bitcoin. – Custody: multi-sig cold storage – Proof of reserve: monthly audits – HOLDing: selling limited to “severe financial crisis” plus strict conditions

This decision could influence other states to follow suit, demonstrating a growing acceptance of digital assets as part of government reserves.

North Carolina’s General Fund has $9.5 billion, allowing for up to $950 million to be used for Bitcoin purchases if the bill is approved.

North Carolina leads in Bitcoin reserves

Copy link to sectionThe proposed legislation, introduced in March 2025, represents an effort to diversify North Carolina’s financial holdings by incorporating Bitcoin.

Spearheaded by Republican Senators Todd Johnson and Brad Overcash, the bill is part of a larger strategy to integrate digital currencies into public investments.

This initiative is not North Carolina’s first attempt at engaging with Bitcoin.

The state already has two pending Bitcoin reserve bills in the House and Senate, reinforcing its growing interest in leveraging blockchain technology.

If successful, the legislation could establish North Carolina as a pioneer in government-backed crypto investments, potentially setting a precedent for other states to follow.

Multi-signature cold storage for security

Copy link to sectionOne of the bill’s key provisions is the use of multi-signature cold storage for Bitcoin holdings.

This security measure aims to reduce risks associated with digital asset theft and unauthorized transactions.

Cold storage, which keeps assets offline, enhances protection against hacking and cyber threats.

To maintain transparency, the state will conduct monthly audits of its Bitcoin reserves.

These audits will serve as proof of reserves, ensuring public confidence and reinforcing accountability in how digital assets are managed.

Given the volatile nature of Bitcoin, these safeguards are designed to mitigate risks and maintain stability in state finances.

Bitcoin sales limited to crises

Copy link to sectionThe legislation imposes strict conditions on Bitcoin sales, limiting transactions to periods of severe financial distress.

This measure ensures that Bitcoin remains a long-term investment rather than a fluctuating asset subject to frequent trading.

By establishing clear guidelines for liquidation, the bill aims to create a stable investment strategy that integrates Bitcoin into the state’s financial system without exposing public funds to unnecessary risks.

This controlled approach seeks to balance the potential gains of Bitcoin investment with the need for financial prudence and responsible governance.

Government interest in cryptocurrency grows

Copy link to sectionNorth Carolina’s move reflects a broader trend of increasing government interest in cryptocurrency.

As digital assets gain mainstream acceptance, states are exploring ways to incorporate them into financial strategies.

Bitcoin’s growing reputation as a hedge against inflation and traditional economic downturns makes it an attractive option for public funds.

However, Bitcoin’s volatility and the lack of comprehensive federal regulations remain key concerns.

While some view this initiative as a step toward financial innovation, others warn of the risks associated with investing taxpayer funds in a fluctuating market.

More industry news