Gold may stay in overbought zone amid persistent global uncertainty

- Gold prices have reached record highs due to investor concerns about trade tensions and potential tariffs.

- Market analysts indicate gold is currently overbought, suggesting potential caution.

- Uncertainty around US trade policies have contributed to gold's appeal as safe-haven asset.

Gold prices can remain overbought or oversold for extended periods of time as investors continue to increase their exposure to the yellow metal, according to experts.

Gold prices on COMEX had hit a record high of $3,263 per ounce on Friday, and traded near that level on Monday as well.

At the time of writing, the June COMEX contract was up 0.6% at $3,245.7 per ounce.

David Morrison, senior market analyst at Trade Nation said:

As things stand, investors continue to increase their exposure to gold on hopes that it will hold its value, acting as a safe haven amid the tariff-induced market uncertainty.

According to Morrison, the daily moving average convergence and divergence indicated that the yellow metal was back at overbought levels. This warrants cautiousness, he said.

Gold at the mercy of Trump tariffs

Copy link to sectionFederal Register filings on Monday revealed that the US is initiating investigations into pharmaceutical and semiconductor imports.

The goal is to potentially impose tariffs on these sectors, citing that heavy dependence on foreign production of medicine and chips poses a national security risk.

Market participants are on edge as US President Donald Trump announced plans to reveal the tariff rate on imported semiconductors within the coming week.

Additionally, Trump stated on Monday that he was open to adjusting the 25% tariffs on imported auto and auto parts from Mexico, Canada, and other countries.

He acknowledged that car companies “need a little bit of time” as they transition to manufacturing in the US.

“However, markets continue to remain wary amid uncertainty over Trump’s trade policies, and his constant backpedalling on tariffs raises worries over the global economic outlook, keeping the sentiment around the traditional Gold price underpinned,” Dhwani Mehta, analyst at FXstreet, said in a report.

Interest rates

Copy link to sectionThe uncertainty surrounding tariffs and other policies has caused the economy to enter a “big pause,” according to Atlanta Federal Reserve Bank President Raphael Bostic.

He suggested that the US central bank should maintain its current position until there is more clarity.

“Meanwhile, markets ignored comments from Atlanta Fed Bank President Raphael Bostic, who suggested that the US central bank should stay on hold until there is more clarity,” Mehta said.

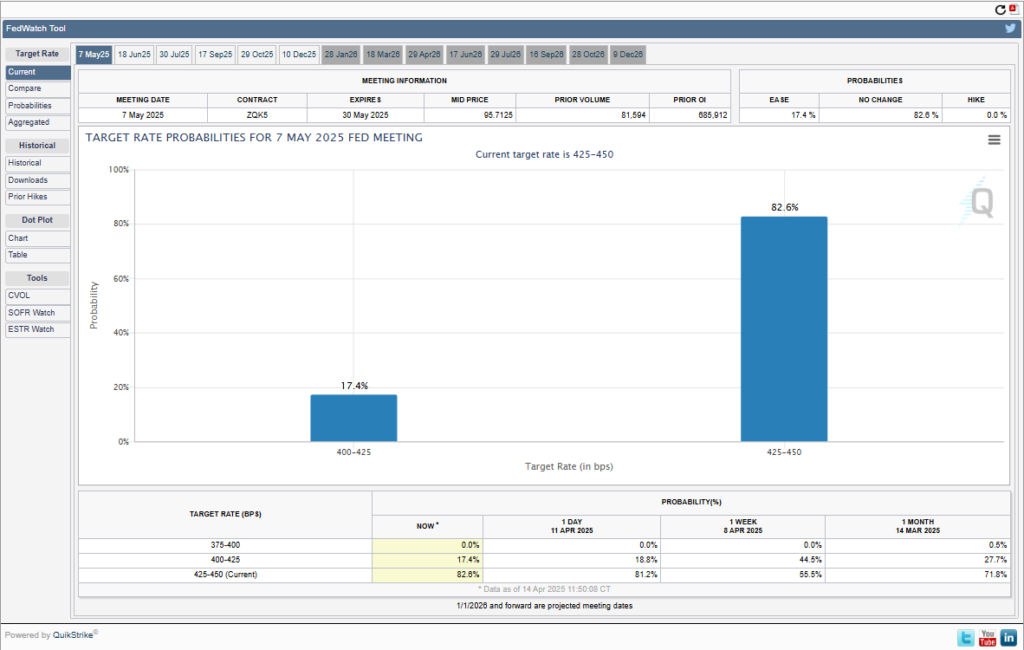

Markets held an 80% probability that the Fed will maintain rates at its May 7 policy meeting. Additionally, they factored in approximately 85 basis points worth of rate cuts by December in 2025.

Trump administration’s tariff policies could force the Fed to cut rates to avoid a recession, even with high inflation, said Fed Governor Christopher Waller on Monday.

US treasuries and gold

Copy link to sectionGold, a non-yielding asset, traditionally acts as a hedge against global uncertainty and inflation. It also tends to flourish in a low-interest-rate environment.

This has been exacerbated by some eccentric moves across the US Treasury market, according to Morrison.

US Treasuries, backed by the balance sheet of the world’s largest economy and the might of the world’s reserve currency, have always been considered the ultimate safe haven.

Investors are not only paid interest, but they also have the assurance of the US economy’s backing.

“But Treasuries have proved to be extremely volatile of late, and have lost some of their appeal,” Morrison said.

Mehta added:

Looking ahead, the further upside in Gold price will likely remain at the mercy of Trump’s tariff headlines and the upcoming Fedspeak as the US calendar remains devoid of top-tier economic data publication.

More industry news