Gold miners ETF outperforming bullion fund

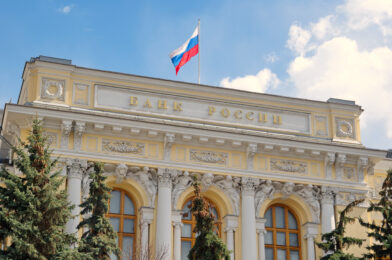

iNVEZZ.com Wednesday, March 19: With the uncertainty surrounding the US economic recovery and the intensifying conflict in Ukraine, investors are again flocking to safe haven assets. Gold has been a long-time darling in times of crisis but this time around, the best returns are coming from the miners instead of from the metal itself.

The Market Vectors Gold Miners ETF has climbed by about 25 percent so far this year, beating the 12.5 percent increase of the SPDR Gold Trust ETF.

According to Bloomberg data, this is the first quarter in which the equities fund is outperforming the metal ETF since 2012. Assets in the GDX have grown six percent in the past four weeks, compared to 2.7 percent for the GLD.

A rally in the US stock markets and slow inflation last year led to a shift away from gold, sending its price to the first calendar year decline since 2000. To combat the slump, mine operators were forced to take at least $30 billion (₤18.1 billion) of write-downs.

Barrick Gold, the world’s top gold producer, divested about $1 billion (₤602 million) of assets, halted mine construction and lowered its all-in sustaining costs in the fourth quarter to $988 an ounce, 14 percent below the year-earlier period.

“Miners got caught in the crush,” says Peter Sorrentino, a senior portfolio manager at Huntington Asset Advisors, as quoted by Bloomberg. “Some of them lowered production and sold off mines and announced write-downs. They fell to a level that bore no resemblance to the underlying economic value, and started to look so attractive.”

The dramatic cost cutting by gold producers is expected to pay off this year though.

Bloomberg projects that the nine largest miners by revenue could deliver $2.31 billion (₤1.39 billion) of free cash flow this year and $4.97 billion (₤3 billion) in 2015, a major improvement from last year’s negative $5.16 billion (₤3.11 billion) and the $4.51 billion (₤2.72 billion) of red ink in 2012.

More industry news