What if the US defaults on its debt?

- The US Treasury will run out of money in early June unless the debt ceiling is raised or suspended

- In case the debt limit binds, the US enters an unprecedented economic and financial crisis

- The views are split on how the US dollar would react should the US default on its debt

Last Friday, the US Treasury issued a warning few people bothered listening. It said that as of May 10, it had only $88 billion to pay government bills.

By early June, it would run out of money, and if the debt limit is not raised or suspended, the US will default on its debt.

This is no small thing.

The outstanding US federal debt limit is $31.4 trillion, hit on January 19, 2023. Through some extraordinary measures, the US Treasury ensured that the debt limit would not bind, but those measures will hold until June only.

Negotiations on the debt ceiling are ongoing, which is a good thing. But is there no risk of the US defaulting on its debt?

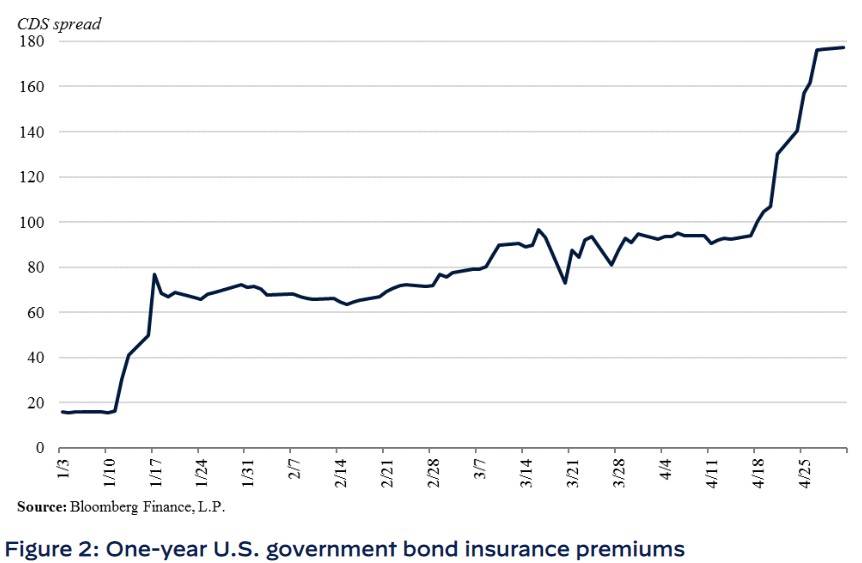

The cost to insure US debt rose significantly in April

Copy link to sectionSure enough, the cost of insuring US debt rose significantly. In April, it exploded higher. Therefore, some investors do not ignore the possibility of the US defaulting on its debt.

What if the debt limit binds?

Copy link to sectionSuch an event is unprecedented. But if it did not happen in the past, it does not mean it won’t happen in the future.

To start with, the Federal Reserve’s Chairman, Jerome Powell, warned about the incalculable negative effects such an event will have. During the last press conference following the FOMC Statement in May, he warned that the Fed would not be able to help financial markets if the debt limit binds.

How would markets react, say, if the Social Security payment is delayed? Or, if it would be a run on money market funds holding short-term US Treasuries?

Moody comes with some estimates – a loss of about 2 million jobs, the unemployment rate to jump to 5%, and the economy to quickly enter a recession.

But above all, THE thing that will be lost (irreversibly) is the trust in the US and its financial strength.

What would happen to the US dollar?

Copy link to sectionThe views are split on the impact on the greenback. Some argue that the US dollar is the first to take a big hit because if Treasury securities are no longer perceived as risk-free, the local currency is the first to go down.

However, some argue the opposite. Because the US dollar is the world’s reserve currency (i.e., foreign countries keep their foreign reserves in dollars), investors will buy it as a safe-haven asset. After all, they did so in the past in different crises, so why not do it again?

This time, though, the risk is that it might be different. Given the situation’s unprecedented nature, no one knows what will happen if the debt limit binds.

One thing, though, is certain. Volatility will explode, bringing extreme levels of uncertainty to financial markets. And that is the last thing the world needs in times of war in Europe, geopolitical tensions, and rising inflation.

More industry news