Is London Stock Exchange (LSEG) stock a buy after earnings?

- London Stock Exchange (LSE) published mixed financial results.

- Its half-year total income jumped by 11.9% to £4.17 billion.

- The company’s growth is being supported by its data and analytics division.

The London Stock Exchange (LON: LSEG) share price plunged and then crawled back on Thursday after the company published mixed financial results. The shares initially plunged to a low of 7,782p, the lowest level since April 19th, and then bounced back to 8,190p. In all, the stock has dropped by over 7.3% from its highest level this year.

LSE growth is slowing

Copy link to sectionLondon Stock Exchange published mixed financial results. In a statement, the company said that its total income jumped by 11.8% to £3.99 billion in the first half of the year. Including recoveries, the company’s total revenue jumped by 11.9% to over £4.17 billion.

LSEG’s adjusted EBITDA rose by 4.1% in £1.87 billion as its margin dropped from 50.4% to 46.9%. At the same time, its profit before tax dropped by 17.6% to £662 million while its operating profit dropped to £729 million.

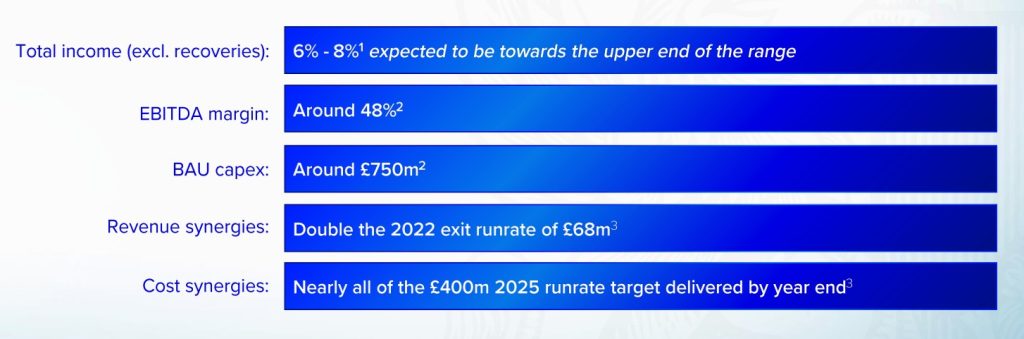

The company also affirmed its forward guidance. Its revenue is expected to come in at the upper end of the 6% and 8%. Its adjusted EBITDA margin will come in at ~48% with capital expenditure coming in at over £750 million.

The London Stock Exchange’s business has been going through challenges in the past few months as the number of IPOs has stalled. The company was recently hit when WE Soda scrapped its plans to list in London.

Despite this, the company’s business has been helped by its data and analytics business. This is a product where the company provides a platform for data that is an alternative to Bloomberg Terminal and FactSet. The division grew after the firm acquired Refinitiv from Thomson Reuters.

This growth has helped boost the company’s recurring revenue to 72%. The data and analytics revenue jumped to over £2.6 billion, higher than its capital markets’ £759 million.

LSEG is also doing well because of its post trade offerings, whose revenue grew by over 19%. It boosted this division with the buyout of Acadia, a company that provides uncleared margin processing and integrated risk services.

London Stock Exchange share price forecast

Copy link to section

The LSEG share price peaked at 8,816p on June 7th and then started retreating. It dropped below the key support at 8,528p, the highest point on July 28 and August last year. The shares have dropped below the 50-day and 100-day moving averages.

The stock moved below the key support at 7,974p, the lowest point on July 11th. Therefore, the outlook for the stock is neutral for now, with the key support and resistance levels to watch being at 7,600p and 8,530p. A break below this week’s low of 7,796p will point to more downside.

More industry news