Is inflation really going down?

- Inflation going down is likely to be temporary

- Central banks have paused their tightening cycle

- Rates may stay higher forever

Major central banks signaled this week that they have reached a point where they are comfortable in their fight against inflation. The interest rate hikes in the last months have started working, as they need time for their effects to be seen.

First, the European Central Bank (ECB) raised rates to historically high levels last week. However, it signaled that it was likely the last increase.

Second, the Federal Reserve of the United States (Fed) stayed put too. It argued that inflation is on track to come down to its target in a timely manner.

Third, the Swiss National Bank (SNB) surprised markets yesterday. It was supposed to hike a quarter of a basis point. Instead, it chose to keep the rates steady.

Fourth, the Bank of England (BOE) surprised market participants when it did not hike as many expected. In a stunning move, the central bank decided to keep rates on hold because the August CPI print is encouraging.

Therefore, one cannot stop wondering if central banks declared victory in their fight against inflation. So, is it all over? Is inflation going down?

Reality check – inflation is not going anywhere anytime soon

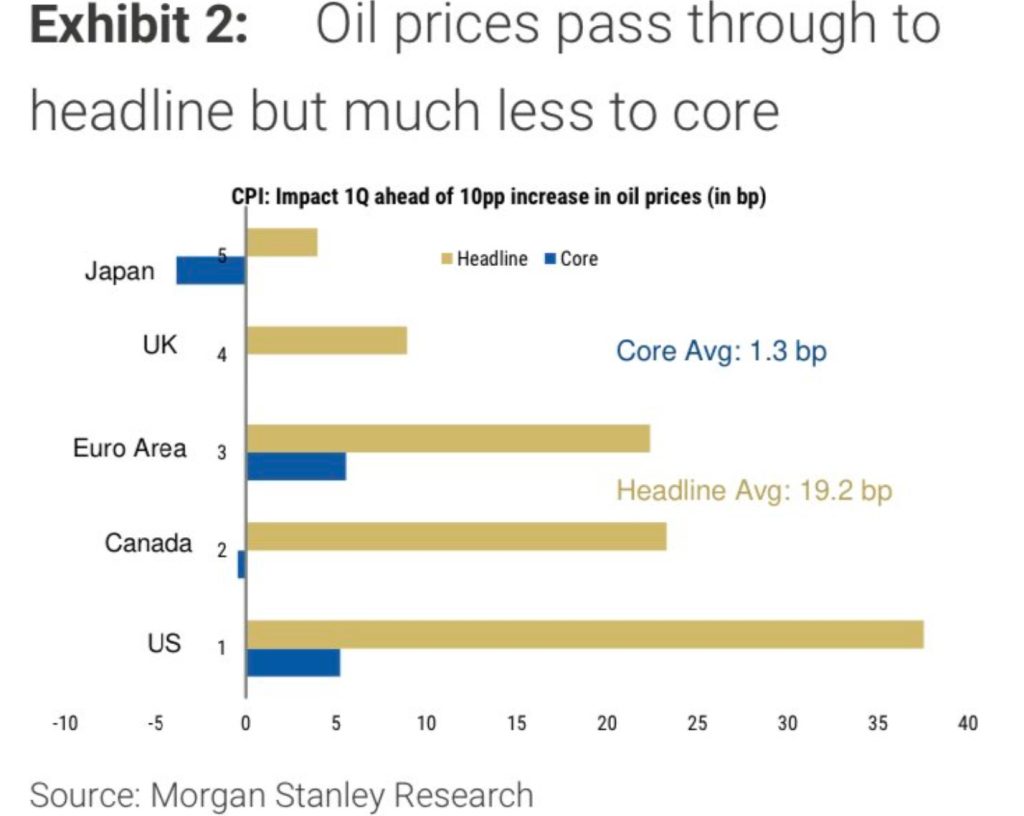

Copy link to sectionOne of the main drivers of inflation is oil. Oil prices are responsible for inflation moving up or down, as changes are immediately transmitted to the economy.

Studies have shown that higher oil prices pass through to inflation at a rate of 20bp for every 10% increase in the price of oil.

Crude oil price is up +25% YTD.

Other examples: orange juice prices (+68% YTD), olive oil (+53 % YTD), cattle live (+20 % YTD). Moreover, cocoa prices are nearing a 44-year high, and sugar prices have reached a 12-year high.

It doesn’t seem that the fight against inflation is over. Therefore, celebrating is a bit earlier.

So, what should be a fair expectation regarding future interest rate levels?

Given that price increases are still the norm, it would be foolish to expect large interest rate cuts in the future. Instead, the rates will likely stay higher for longer – and maybe even forever, as inferred by the Wall Street Journal.

More industry news