US dollar’s decline raises question: can the euro become the next global reserve currency?

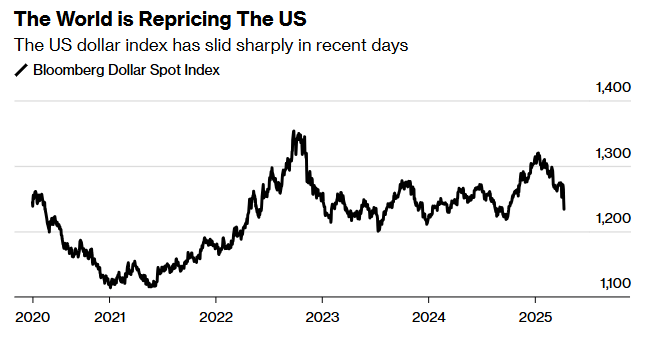

- The dollar has dropped almost 10% this year, triggering global investor concern in the reserve currency.

- Trump’s tariff policies and debt threats are accelerating de-dollarisation.

- The euro is gaining momentum through new policies as investors seek the next safe haven currency.

The US dollar has been the anchor of the global financial system for decades now. But in recent weeks, market behaviour has started to tell a different story.

As President Donald Trump continues to double down on tariffs and policy threats, capital is beginning to move elsewhere.

What used to be as the safe haven currency is now treated as a liability. And while investors are losing their confidence in the dollar, the euro is moving in the opposite way.

You don’t usually see that outside of wars or financial crises. But now, serious discussions are emerging around whether the US dollar could realistically be replaced as the world’s reserve currency.

What just happened to the US dollar?

Copy link to sectionOn Friday, April 11, the US dollar fell to a three-year low against a basket of major currencies.

It has dropped close to 10% since the beginning of the year. The euro alone has gained 9% since late February, reaching 1.14 dollars. Traders call it one of the sharpest shifts in currency markets since 2008.

The stock market hasn’t fared better. The “Sell America” trade has gained momentum in past weeks. Nearly $5 trillion has been wiped off US equity valuations over this period.

The bond market, which is usually a safe haven during volatility, is no longer behaving like one.

The yield on 30-year US Treasuries jumped from 4.4 to 4.8% in just one week, the sharpest rise since 1982.

This isn’t a normal market correction. It’s a rare moment where both US equities and Treasuries are falling together.

That usually only happens when investors begin to lose faith in the system itself.

Why is this different from previous sell-offs?

Copy link to sectionThe trigger was Trump’s so-called “Liberation Day” tariff package. But the reaction has gone far beyond short-term concerns.

What’s playing out now is a broader reassessment of the dollar’s role in the global economy. Others describe it as “de-dollarisation”.

Foreign purchases of US debt turned negative in January for only the second time in four years.

Central banks are starting to diversify. Investors are moving into euros, yen, gold and Swiss francs. Even Canada and Australia are seeing mild bumps in currency demand.

Christine Lagarde, president of the European Central Bank, said this week that Europe must be ready for anything, including scenarios where dollar access is restricted or trust in US commitments weakens.

Her message to EU leaders was blunt: stop waiting.

Has Trump accelerated the decline?

Copy link to sectionYes. What used to be called the “exorbitant privilege” of the US, that was the ability to borrow cheaply because the world wants your currency, is now starting to look more like a liability.

Trump’s trade war has targeted allies and adversaries alike. He’s hinted at defaulting on parts of the $34 trillion national debt.

Some aides reportedly want to convert short-term Treasuries into 100-year bonds with extra taxes on foreign holders. Others speak openly about a modern version of the Plaza Accord to devalue the dollar by force.

This is economic brinkmanship. And markets are responding accordingly.

Former US Treasury official Mark Sobel, says that while there is no viable alternative to the dollar today, Trump is undermining the institutional foundations that made dollar dominance possible in the first place.

The world no longer assumes that the US will act responsibly in a crisis. That’s new.

Can the euro fill the gap?

Copy link to sectionIn order for another currency to overtake the silverback, a few requirements must be met, at least in theory. One of the biggest examples is functioning as the dominant global foreign exchange reserve currency.

Right now, the euro accounts for about 20% of global foreign exchange reserves. That number hasn’t changed much in a decade. The US dollar still accounts for nearly 60%.

At the same there is a big gap in the treasury market of Europe and the US. The US Treasury market is $28.6 trillion deep.

The eurozone’s entire government debt stock is just under €13 trillion, and only €4 trillion of that qualifies as safe by central bank standards.

In addition, there is no unified eurobond market. Cross-border banking in the EU is still inefficient. And during crises, it’s still the Fed that provides global liquidity through swap lines.

Nevertheless, there might still be hope for Europe. The euro’s recent strength has been backed by a realignment in European policy.

Germany is relaxing its fiscal rules. The EU plans to spend more than 800 billion euros on defence by 2030. This would provide a sense of legitimacy in the euro.

If executed, this would create more euro-denominated assets for the world to hold. It would also deepen eurozone capital markets, which have always been too fragmented to rival US Treasuries.

So while the euro is rising, it’s not ready to take over. At least not yet.

What’s the plan for the euro?

Copy link to sectionThe dollar is not going to disappear from the global system. It still underpins energy trade, global debt markets, and central bank reserves.

But it is no longer alone. We are moving toward a more fragmented, multipolar financial order.

The euro is the most likely challenger, but it needs political backing and coherent strategy.

Several leading economists have laid out what Europe would need to do. Expanding the pool of euro-denominated safe assets is an essential first step.

Then, the EU must build euro swap networks that mirror the Fed’s emergency lending to foreign banks, and push for more trade invoicing in euros, especially in green energy and critical minerals.

Lagarde has echoed this vision, saying the euro can become the currency of the green transition.

That’s not just about branding. It’s about creating a new foundation for value, just like oil did for the dollar. Already, most green bonds globally are denominated in euros.

If Europe can price more of the world’s clean technology and infrastructure in euros, its role could grow naturally. Maybe not by overtaking the dollar, but by reducing the world’s over-reliance on it.

A likely scenario

Copy link to sectionYes, the US dollar is slowly losing the conditions that uphold its reserve status. And no, no other currency is ready to replace it, yet.

What we’re seeing is not an abrupt collapse, but a gradual shift toward a multipolar reserve system.

This is a system where the euro is gaining traction in European trade and green finance.

The renminbi continues to extend its influence through Belt and Road economies. And finally, the yen, Swiss franc, Canadian dollar, and Australian dollar serve their respective regions and functions within the system.