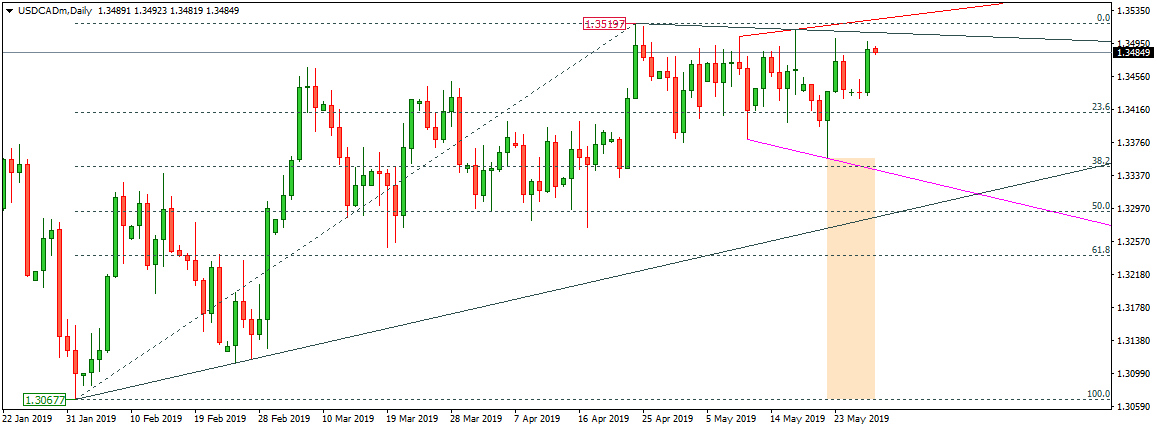

Forex Trading: USDCAD Technical Analysis – May 29, 2019

The US Dollar (USD) inched lower against the Canadian Dollar (CAD) on Wednesday, decreasing the price of USDCAD to less than 1.3500 following some key economic releases. The technical bias may remain bearish because of the higher low in the recent upside move.

USD/CAD Technical Analysis

Copy link to sectionAs of this writing, the pair is being traded around 1.3484, A support can be noted near 1.3411, the key horizontal support level ahead 1.3347, the 38.2% Fib level support level and then 1.3285, the trendline support level as demonstrated in the given below chart.

On the upside, resistance can be noted around 1.3522, the trendline resistance ahead of 1.3600, the psychological number and then 1.3661, the major horizontal resistance as demonstrated in the given above chart. The technical bias shall remain bearish as long as 1.3639, the trendline resistance level remains intact.

USD Labor Force Participation Rate

Copy link to sectionIn the United States, the figure concerning labor force participation rate remained 63.0 in March, as compared to 63.2 during the month before, up beating the economist expectation which was 62.9. The data is copied from the news released by the Bureau of Labor Statistics Department of Labor, United States.

The data is derived after taking into account the age factor of labors including both working and those who are still looking for a job. It is presented in percentage of the total number of people either being employed or unemployed. Generally speaking a high reading in this regard is considered as a bullish trend for the US Dollar (USD) and vice versa.

Trade Idea

Considering the overall price behavior of the pair over the last couple of days, selling the USDCAD around current levels can be a good decision in short to medium term. Therefore, sticking to economic calender only might not work, you also need to find brokers offering exceptional leverage level so you may find some margin while trading your pair around. However, take note that high leverage can also lead you to severe losses if there no negative balance protection is in place.

More industry news