Here’s how Stellar price could gain further 10% this week

- Stellar Foundation will team up with its anchors to work on a new payment standard

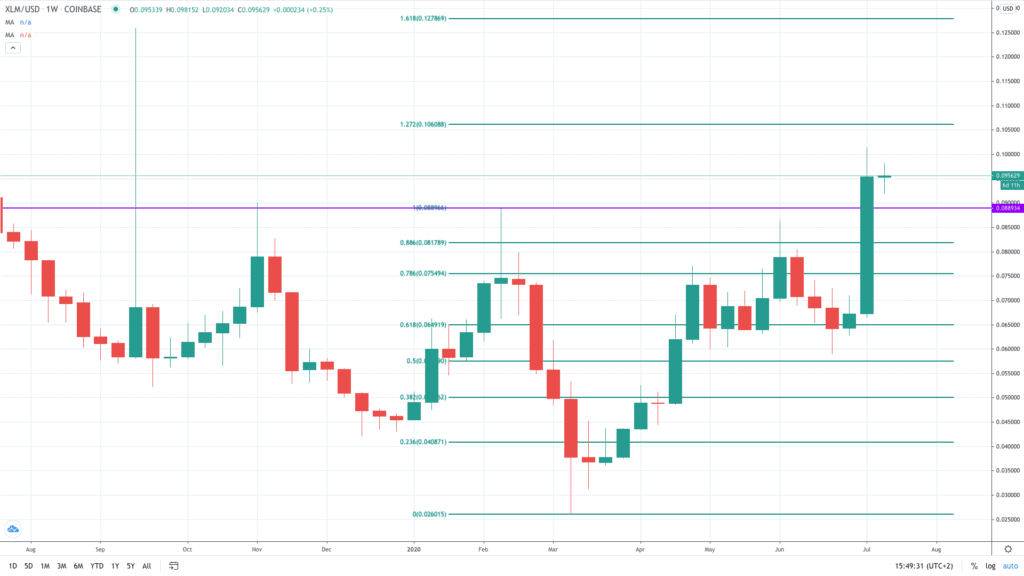

- XLM/USD price is up nearly 50% higher in July to trade above $0.1 for the first time since September last year

- The bulls are now looking to extend the rally towards the 127.2% Fibonacci extension near $0.1060

Stellar Lumens (XLM) price has continued its impressive form in July to trade above $0.1 for the first time since September last year. The buyers are now eyeing a move towards $0.1060, which represents a premium of 10% compared to the current market price.

Fundamental analysis: SDF working on a new payment standard

Copy link to sectionThe Stellar Development Foundation (SDF) recently published a recap of a webinar that was held to talk about the role of anchors and the Stellar Lumens platform in developing a new payment standard.

Stellar will team up with its anchors to try and merge different systems and help realize the changeover from traditional payment systems to the Stellar network, said the foundation. The goal is to do this by 2025.

“To facilitate moving value from the traditional banking system into Stellar and vice-versa, the network relies on what we call anchors. Anchors play a fundamental role in creating a decentralized, interoperable global financial system,” the SDF noted in a recap.

According to the foundation, the anchors play a key part in developing the new payment standard. The anchors refer to regulated financial organizations, money service businesses as well as fintech companies. They have two essential functions for the network.

The first function is that the anchors serve as an issuer of fiat-powered tokens, called stablecoins, which aim to generate liquidity for the Stellar network consumers. Otherwise stated, the anchors serve as a bank that holds the fiat money reserves.

Their second function is to serve as a gateway for fiat money consumers to enter and exit the Stellar network tokens. Another significant role of anchors includes linking the Stellar network to the banking network of the country where the network is based.

As a result, anchors must be regulated and run with a Know Your Customer (KYC) process that enables consumers to conduct quick deposits and withdrawals.

“As the critical link between the Stellar network and the traditional banking system in their respective countries, anchors are positioned to leverage a variety of business models and monetization strategies, including deposit/withdraw fees, FX spread, seigniorage, and transaction fees”.

Invezz reported last week that Stellar network rolled out an upgrade for its core protocol in June.

Technical analysis: Bulls eye new gains

Copy link to sectionStellar (XLM/USD) price is trading nearly 50% higher in July. Even more importantly, the latest rally has seen the price trading comfortably above the $0.09 mark. This resistance capped multiple rallies in the past few months.

As seen in the chart above, the bulls are now looking to extend the rally towards the 127.2% Fibonacci extension near $0.1060. This would translate into a 10% rally from the current XLM levels. If investors continue to invest in Stellar Lumens, we may see a move all the way towards $0.13, where the 1-year high is located.

Summary

Copy link to sectionStellar price is enjoying an impressive month of July, being almost 50% up. The buyers are now preparing to try and push the price action above the $0.1 resistance to add a further 10% to its recent gains.

More industry news