Soybean prices gather momentum ahead of the March WASDE report

- soybean prices are gaining momentum as investors await the March WASDE report later today.

- Analysts expect the USDA to lower their stockpiles estimates due to unfavorable weather in South America.

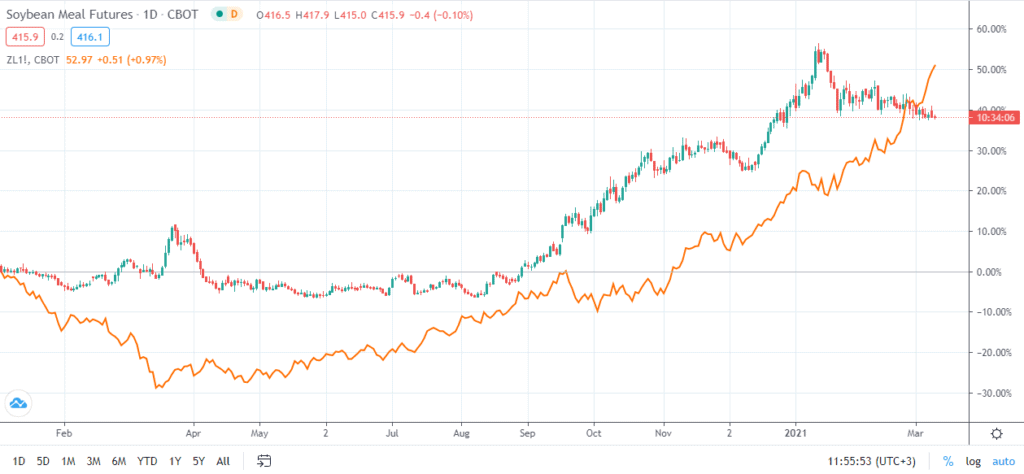

- Soybean meal futures are on a decline while soybean oil futures are close to a 8-year record high.

Soybean prices were up by 0.28% to $1437 ahead of the WASDE report later today. While soybean meal futures are down by 0.19%, soybean oil futures are trading close to yesterday’s 8-year record high. Investors are awaiting the WASDE report later today.

Upcoming WASDE Report

Copy link to sectionSoybean prices were up on Tuesday’s session as investors looking to invest in commodities await the WASDE report scheduled for later in the day. In February’s report, the US Department of Agriculture adjusted its forecast of 2020/21 US soybean exports. The agency predicted that the exports would rise by 20 million due to harvest delays in Brazil. However, its predictions for US soybean prices remained unchanged at $11.15 per bushel.

South American weather

Copy link to sectionSoybean prices are finding support from the ongoing supply woes. The weather in Brazil and Argentina is particularly of interest to investors in the soybean market. Brazil, which is the top soybean exporter in the world, has been experiencing significant rainfall. The wet weather has continued to hamper harvesting in the area. This environmental challenge, which is bound to continue over the coming week, has particularly affected key soybean-growing regions like Sao Paulo, Mato Grosso do Sul, Parana, and Mato Grosso. Subsequently, there has been a delay of soybean shipments from Brazil.

On the other hand, Argentina is experiencing dry weather conditions. The South American country is one of the top soybean producer and exporter of soybeans in the world. As such, USDA is likely to lower its estimates for global soybean supply.

Soybean demand

Copy link to sectionChina’s hunger for agricultural products has been one of the key drivers for the ongoing bull market. China imports soybeans for crushing into soymeal for livestock feeds and soyoil for use as vegetable oil.

Between early August 2020 and mid-January 2021, soybean prices had risen by about 39.75%. The continuation of the uptrend into the new year was seen as a signal that the country’s buying spree would continue. Besides, analysts like Goldman Sachs and JP Morgan forecasted 2021 to be the onset of a prolonged bull market for commodities.

However, China’s demand for soymeal has slowed down following the recent outbreaks of the African swine flu in some provinces within the country’s north and north-eastern regions. According to the General Administration of Customs, soybean imports to China were at 13.41 million tonnes in the first two months of 2021. The figure was a decline of 0.8% from the same period in the past year. 2020’s record imports were due to the stabilization of the pig herd and the improvement of margins.

Nonetheless, the Middle Kingdom’ imports of edible oils rose by 48% to 2.04 million tonnes between January and February 2021 from last year’s similar period. On Tuesday’s session, soybean meal futures were down by 0.19% at $415.5. On the other hand, soybean oil futures are trading close to the record set in the previous session. The edible oil futures are at their highest price since February 2013.

More industry news