Carnival Stock Price Correction Continues Ahead of Q3 2021 Earnings

- Carnival (NYSE: CCL) stock price is well off its 2021 highs ahead of the Q3 2021 earnings.

- What Are the Expectations for Q3 2021 Earnings?

- The company keeps losing money, and forecasts are gloomy for the quarters ahead.

Carnival (NYSE: CCL) stock price is well off its 2021 highs ahead of the Q3 2021 earnings. Investors expect EPS of $-1.46 to be announced at today’s earnings conference.

Carnival is an American leisure travel company headquartered in Miami, Florida, that operates 87 ships and sends them to over 700 ports worldwide. Its business model was severely disrupted by the COVID-19 pandemic, as cruisers were forced to hold ships at the shore.

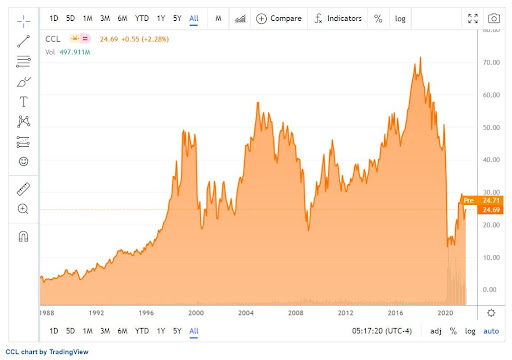

As a consequence, Carnival stock price declined abruptly. It dropped from above $70 to below $20 but bounced on optimism that the pandemic may soon be over and people will start travelling again.

However, the road ahead is long and difficult. The company keeps losing money and is forecast to do so also in the following quarters. Carnival stock price is up by 13.99% YTD and 74.73% in the last 12 months.

What Are the Expectations for Q3 2021 Earnings?

Copy link to sectionThe market expects EPS of -$1.46 on the quarter, higher by 33.51% compared to the same period last year. However, because Carnival missed expectations in the previous four quarters, the risk is that it would do so again.

The company keeps losing money, and forecasts are gloomy for the quarters ahead. Investors expect the company to return to profitability only in 2023, so the pressure on Carnival stock price might continue. EPS are expected to reach $0.01 by 2023 and $0.02 by 2025.

Carnival stock price reached as high as $31 in May this year, correcting ever since. It now trades at $24.69, up by 4.57% ahead of the Q3 2021 earnings.

More industry news