Eurozone’s M3 continues downtrend; German Ifo data surprises to the upside

- Money supply in the eurozone fell less than expected in September 2023.

- A survey of German business conditions proved to be more optimistic than anticipated.

- Some commentators believe that German manufacturing may begin to recover in the coming months.

Earlier today, the European Central Bank (ECB) released the latest monetary aggregates data for the European bloc.

M3 data for September 2023 came in at EUR 16.02 trillion (£13.97 trillion), dropping 1.2% since August 2023.

The reduction was limited compared to the (-)1.7% fall suggested by consensus estimates published by TradingEconomics.com and was also shallower than August’s 1.3% decline.

The difference compared to market expectations suggests that monetary authorities are being more cautious given the broader weakness throughout eurozone economies coupled with a challenging macroeconomic and geopolitical backdrop.

M1, which includes currency in circulation and overnight deposits fell by (-)9.9% against the previous month’s decline of (-)10.4%.

Other components of broad money, M3, such as short-term deposits (other than overnight), i.e., M2-M1, moderated to a growth rate of 22.0% YoY as compared to 23.7% YoY in August; while marketable instruments, i.e., M3-M2 fell to 19.1% YoY from 20.5% YoY in the previous month.

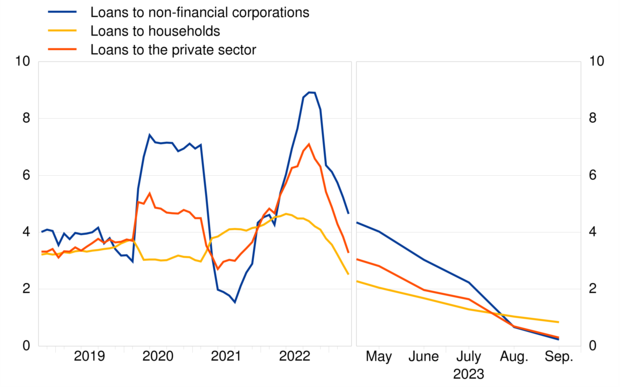

Bank lending to non-financial corporations

Copy link to sectionLoans to non-financial corporations actually witnessed an uptick of 0.2% YoY to EUR 5.135 trillion in the month of September, but this also marked the slowest such growth since way back in September 2015.

This suggests that credit appetite is waning, financially viable opportunities are drying up, and the economy may be heading into a period of stagnation.

Household credit

Copy link to sectionAcross the eurozone, September 2023 bank lending to households was also subdued at 0.8% YoY, returning the lowest such growth since June 2015.

This also missed consensus estimates of 1% YoY, thus dipping below last month’s growth which was also at 1% YoY.

The combined private sector credit growth which is inclusive of both households and businesses in the eurozone fell to 0.2% YoY moderating from 0.6% in August 2023.

The above graph is a reflection of the hawkish policy of the ECB and the tighter financial environment prevalent throughout the bloc.

Inflation picture

Copy link to sectionIn the Euro area, annualized inflation was 4.3% for September 2023.

This was sharply lower than the 9.9% YoY recorded for the same period in the previous year.

However, with inflation still being well above target, and given concerns around elevated energy costs and potentially excessive support during the global pandemic, some economists believe that inflation may yet see a resurgence in Europe.

Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, argued,

Therefore, there is much to suggest that a recession in Germany is well underway… (however) there is no reason to pull the plug on inflation concerns.

Today, German inflation stands at 4.6% YoY for September 2023, while the second-largest economy of the bloc, France, saw headline inflation at 4.9% YoY for the month.

Norman Liebke, Economist at Hamburg Commercial Bank added that this may prove to be a sticky situation for policymakers, since,

(The ECB) more or less signaled at its last meeting that no further rate hikes will be carried out.

To combat inflationary forces, European monetary aggregates are likely to continue to shrink through the rest of the year, despite disappointing PMI data and an uptick in recessionary concerns.

German Ifo data

Copy link to sectionThe Ifo Institute released its Business Climate Index, which saw a surprise uptick to 86.9, beating both the previous month’s reading of 85.8 and consensus expectations of 85.9.

The fresh data comes a day after the GfK Consumer Climate Indicator for Germany underperformed expectations and declined for a third successive month, implying a weak demand trajectory.

Despite this, the Ifo data marked the first increase in the index since April 2023 when it found its twelve-month peak at 93.5, thus, showing the first improvement in six months.

By the end of Q4, the index is expected to trend higher to 89.10.

However, this is still rather subdued compared to the average of 97.37 between 1991 and 2023, which implies that the economy may still see a contraction in the coming months.

The bounce in business morale may be somewhat reactionary given that Germany slipped into a technical recession in Q1 2023, while there is optimism that the manufacturing sector may have bottomed out.

Yet, the improvement in the business climate was in line with the Current Conditions Index which witnessed its first rise since March 2023, reaching 89.2 for October 2023.

The index outshone last month’s reading of 88.7 and was better than consensus expectations of 88.5.

This was the highest such reading for the past three months, indicating a boost to business sentiments among German firms.

Analysts project that this gauge of the health of economic activity will see an uptrend to nearly 93.0 by the end of 2023.

The growing optimism has fuelled an increase in expectations as well, with the Ifo Expectations Index jumping to 84.7 in October from 82.9 in September, having followed a sustained decline since April 2023.

By the end of the year, analysts at TradingEconomics.com project that business expectations will rise to 86.70 while increasing much more radically to 101.0 for 2024.

In such a scenario, Ifo expectations would not be far off from their all-time high of 106.10 registered in November 2010.

However, it is difficult to understand how expectations would continue to improve given the geopolitical concerns around Israel-Palestine, potential disruption from the Ukraine war, elevated fuel costs, and frosty relationship with China.

The reality is that German policymakers may have potentially done a lot of harm to businesses by continuing to alienate their largest trading partner which would impact cost-effective imports as well as lay hurdles when accessing a large target market.

Conclusion

Copy link to sectionWith inflation remaining elevated in the eurozone, M3 has continued to reduce, while loans to businesses and households alike have moderated steeply.

As per TradingEconomics.com, by the end of the year, M3 is forecast to reduce to EUR 15.5 trillion, a decline of 3.3% since the latest report, and necessary to curtail inflationary pressures.

Germany’s Ifo data was surprisingly optimistic.

Part of the improvement may have come from the expectation that manufacturing in the country may finally be seeing a turnaround from its prolonged and uncompetitive decline, with de Rubia noting,

Manufacturing might return to growth territory in the early part of next year.

Whether this will actually materialize is to be seen given the continued elevated fuel costs, demand for higher wages, weaker demand in overseas markets, and the rocky relationship with China.

Despite the positive picture painted by Ifo data, Germany continues to be in precarious territory, and could well see itself not only falling into another recession but also having to contend with stubborn inflation.

More industry news