RAY’s market cap slips below $1B as Pump.fun challenges Raydium’s DEX lead

- RAY led Monday losses as it crashed by nearly 30% within hours.

- Speculation of Pump.fun launching AMM to replace Raydium triggered the fallout.

- Pump.fun has propelled Raydium’s business as all tokens on SOL ecosystem graduate to the DEX.

Raydium’s native token plummeted on Monday as bearish sentiment limited Bitcoin’s movements around $95K.

While broad market weaknesses contributed to RAY’s slump, rumors of Pump.fun’s upcoming AMM pools dented Raydium’s DEX business.

These speculations have seen Raydium’s market cap dipping from $1.237 billion to press time’s $905K within hours.

Pump.fun has fueled Raydium’s growth in the decentralized exchange (DEX) sector as graduated assets have moved to RAY’s AMM after attaining adequate trader interest.

Automated market makers replace outdated order books with an advanced mode that leverages liquidity pools and algorithms to set token prices based on demand and supply.

Pump.fun to launch its AMM pools

Copy link to sectionX user Trenchdiver confirmed that Solana’s meme token Launchpad would introduce its AMM liquidity pools.

EXCLUSIVE : @pumpdotfun is working on their own AMM liquidity pools, which is currently being tested on amm.pump.fun It seems they are planning to have pump tokens graduate to their own pools instead of Raydium so they can either extract more fees on Solana or have…

With the new feature, the platform may no longer need Raydium as graduating tokens would migrate to Pump.fun pools.

Trenchdiver shared a link that shows the new functionality is in beta, confirming a work in progress.

Moreover, the website’s security licenses seem legit and indicate a connection with Pump.fun.

Raydium’s DEX dominance faces disruption

Copy link to sectionA Pump.fun-owned AMM threatens Raydium’s business as the shift removes the latter as the default DEX for new Solana-based assets.

According to analyst Master of Crypto on X:

If Pump.fun’s pools are successful, they may not depend on Raydium anymore, weakening the partnership that helped Raydium expand. Raydium will need to add new features and come up with new ideas to keep up.

Moreover, a Pump.fun-run AMM will likely drain liquidity from Raydium DEX and make the former handle transaction fees.

Besides bolstering its revenue, the new model will improve Pump.fun’s control over its meme token ecosystem, laying the groundwork for future developments.

Pump.fun’s external transactions depend on Raydium under the prevailing model.

That means Raydium determines liquidity stability and users’ trading experience.

With its AMM pools, the meme token Launchpad will have complete control over policies, liquidity, and fee distribution.

That can help Pump.fun enriches its DeFi landscape with more products, including lending protocols and perpetual contracts.

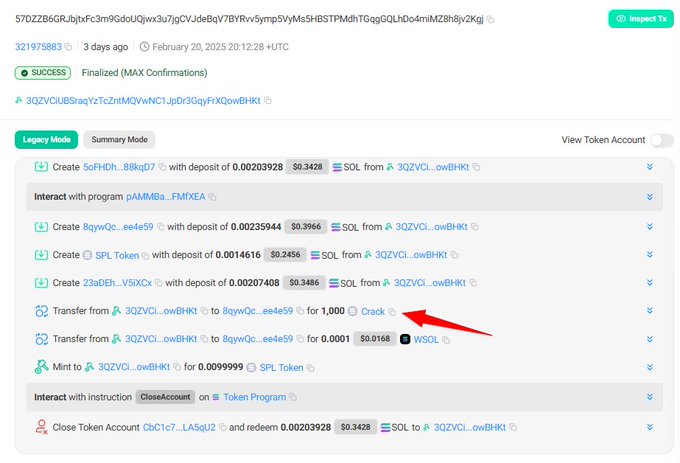

Sources indicated that Pump.fun will add CRACK as the first coin into its AMM pools.

RAY price outlook

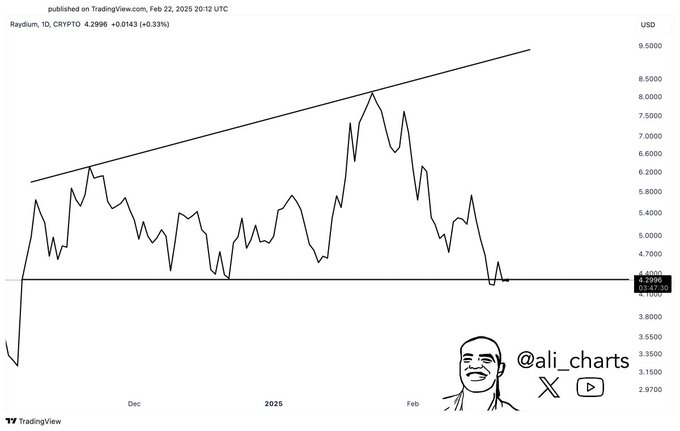

Copy link to sectionThe DEX’s native coin trades at $3.07 after dropping nearly 30% over the past day.

The amplified trading volume likely reflects increased trader activity as players exit to avoid further losses.

RAY might witness extended challenges as Pump.fun shakes its DEX business.

Analyst Ali Martinez observed an emerging right-angled upward broadening setup.

However, RAY seemed to breach the pattern to the downside, a move that could attract significant price slumps.