How is the SPYI ETF doing as the US stock market drops?

- The SPYI ETF has retreated and underperformed the market this year.

- Its total return this year has been minus 9.9% in 2025.

- There are concerns about the ongoing trade war and AI challenges.

The Neos S&P 500 High Income (SPYI) ETF has retreated this year as American stocks dived amid concerns about the technology sector and the ongoing trade war between the United States and China. After peaking at a record high of $51.40 in February, the stock has plunged to $46. So, is the 13.4% yielding fund a good investment to buy?

What is the SPYI ETF?

Copy link to sectionThe Neos S&P 500 High Income ETF is a popular covered call ETF that directly exposes investors to the S&P 500 index, while generating higher monthly income.

Its main advantage against the S&P 500 index is that it offers a higher monthly dividend than the S&P 500 index. It has a dividend yield of about 13.4%, compared to the S&P 500, which yields less than 2%.

The SPYI ETF is similar to JPMorgan’s JEPI fund, which has accumulated over $40 billion in assets under management. The only difference is that it tracks all companies in the S&P 500 index, while JEPI focuses on about 135 companies.

After investing in these companies, the SPYI fund generates an income by writing call options on the S&P 500 index. A call option is a trade that gives investors a right but not an obligation to buy an asset. This call option trade gives it a premium, which it distributes to its investors.

Therefore, the SPYI ETF makes money in three main ways. It benefits when the stock is in a strong uptrend, dividend payouts, and the covered call option trade.

How is the SPYI ETF doing?

Copy link to sectionSPYI and other covered call ETFs are built to do better than the S&P 500 index in periods of high volatility. That’s because the covered call premium helps to compensate the ongoing decline in the stock market.

Also, as a dividend-focused fund, the payout ratio increases as the fund goes down. That happens because the amount of dividend payouts to investors remains the same as the stock price drops.

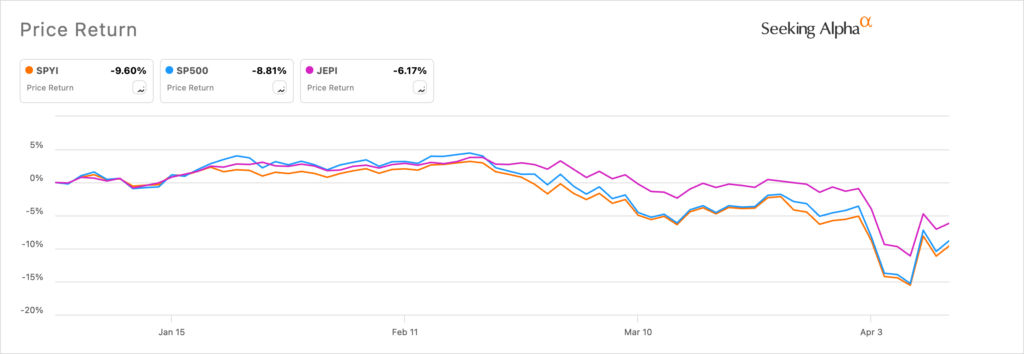

The SPYI ETF and other American stock indices have plunged this year because of the ongoing jitters on trade and artificial intelligence. According to SeekingAlpha, the total return of the S&P 500 index this year is minus 8.8%.

In contrast, the SPYI ETF has a total return of minus 9.60%, while JEPI has been a better performer, dropping by 6.17%.

Is SPYI ETF a good investment?

Copy link to section

Therefore, the question is whether the SPYI fund is a good investment to use. History shows that the S&P 500 index has better returns than the top covered call ETFs when considering the total return. Unlike a price return, the total one considers the dividend returns.

Therefore, analysts recommend investing in the popular S&P 500 index because of its long performance history. Also, popular S&P 500 funds like VOO and SPY charge a small fee to their investors.

SPY has an expense ratio of 0.09%, while VOO and IVV charge a tiny fee of 0.03%. In contrast, SPYI has a ratio of 0.68%, while JEPI charges 0.35%.

Other analysts recommend investing a large portion of their funds in S&P 500 index and a portion of it to the covered call ETFs like SPYI and JEPI.