Yield App 2025

Investing options: 4

Platforms & usability: 4.6

Products, markets, & assets: 4.1

Safety & reliability: 4.8

Deposits & withdrawals: 3.9

Research & analysis tools: 3.8

Fees & costs: 4.5

Education & learning resources: 3.9

Yield App Summary

James Knight

Editor of Education

- Stock Market

- Cryptocurrencies

- Commodities

- Investing

- Sport

Our opinion of Yield App

Yield App is one of the best beginner-friendly crypto interest platforms. The platform has a focus on protecting your capital while generating sustainable returns over the long term, which is perfect for a casual user dipping into earning yields for the first time.

Daily payouts and the option to invest in flexible products with no lock-up period, alongside low minimum deposits, mean it’s ideal for trying things out while keeping a tight rein on your money. For more confident users, we found the longer term lock-ups equally good, with higher rates of interest on offer in return for a longer commitment.

Read the rest of our review of the platform to find the results of our testing, along with our favourite features and our pros and cons.

Yield App highlights

| Features | Yield App summary |

|---|---|

| No. of tradable assets | 9 |

| Min. Deposit | £1/€1 |

| ID verification required | Yes |

| Free demo account | Yes |

| Supported assets | Crypto |

| Mobile trading app | Yes |

| Web trading platform | Yes |

| Regulatory bodies | OAM |

| View more > | Yield App > |

Pros & Cons

Pros:

Cons:

Can I open an account with Yield App?

Yes, residents of China can open an account with Yield App.

No, residents of China cannot open an account with Yield App. Consider trying our best-rated broker in , . Find the best broker in

Investing options

4

What can I do with Yield App?

Yield App is both a place to earn interest through a crypto savings account and an exchange where you can swap between coins with no fees.

The primary selling point is the way Yield App offers you exposure to innovative digital asset investment strategies, which are designed to appeal to everyone through a diverse array of risk profiles. These strategies allow Yield App to pay out daily interest on supported crypto assets.

The exchange, meanwhile, is a no-fee platform where you can buy and trade crypto. It’s designed so that you can get started with as little as £1/€1.

What accounts does Yield App offer?

Yield App offers a place to store and earn interest on your crypto, along with a trading platform.

| Account types | Yield App accounts | Immediate Prime accounts | Quantum Maxair accounts |

|---|---|---|---|

| Trading platform | Yes | – | – |

| Crypto staking | Yes | – | – |

| Crypto wallet | Yes | – | – |

| Money management | No | – | – |

| Spread betting broker | No | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

It also offers a range of account tiers, so that you qualify for higher rates of interest and additional perks based on the amount of YLD tokens in your account.

For instance, to qualify for the highest rates of interest, which are paid on tokens locked up for 365 days, you must stake more than 20,000 YLD.

| Account tier | Qualifying balance |

|---|---|

| Bronze | 0-999 YLD |

| Silver | 1,000-9,999 YLD |

| Gold | 10,000-19,999 YLD |

| Diamond | 20,000+ YLD |

| View more > | Yield App > |

Products, markets & assets

What products and assets can you trade on Yield App?

Yield App is a digital asset platform, where you can trade and earn interest on a handful of cryptocurrencies.

| Product | Yield App assets | Immediate Prime assets | Quantum Maxair assets |

|---|---|---|---|

| Crypto | 9 | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

Crypto

What cryptocurrency pairs can be traded on Yield App?

The majority of the cryptos on Yield App are stablecoins. However, you can also buy, trade, and earn on Bitcoin, Ethereum, Avalanche, and Binance coin as well.

| Cryptocurrency | Cryptocurrency | Cryptocurrency |

|---|---|---|

| Bitcoin (BTC) | Ethereum (ETH) | Tether USDt (USDT) |

| USD Coin (USDC) | TrueUSD (TUSD) | Yield App (YLD) |

| BNB (BNB) | Avalanche (AVAX) | Dai (DAI) |

| View more > | Yield App > |

What are the fees for buying and selling cryptocurrencies?

There are no swap fees on Yield App, though you may be charged a small spread on each transaction. This varies depending on the volatility of the asset, so it’s likely to be higher for YLD than for BTC, for example.

Does Yield App offer staking and rewards?

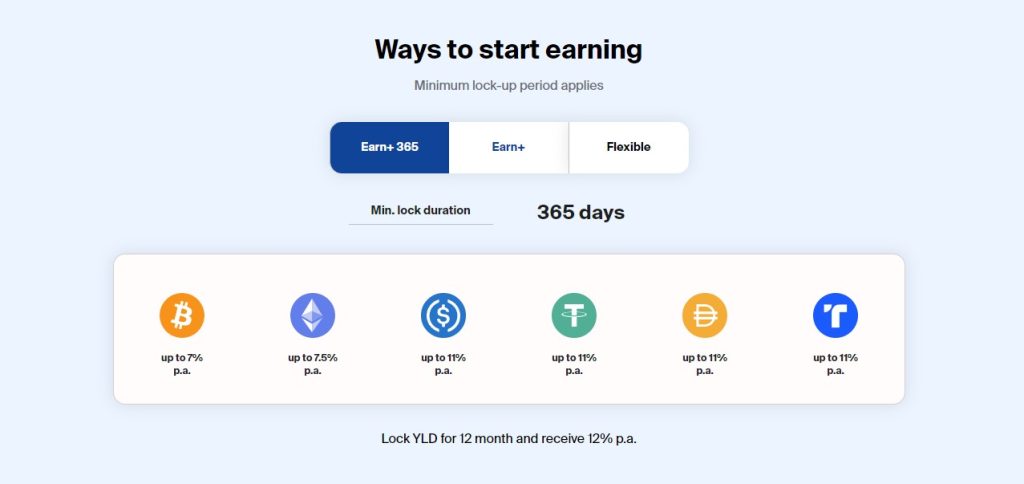

Yes, Yield App offers lots of ways to earn interest through its Flexible, Earn+ and Earn+ 365 products. You can earn up to 11% interest on stablecoins, with daily payouts.

Deposits & withdrawals

What are the minimum & maximum deposits?

The minimum deposit is £1/€1. There are no minimum deposits.

| Payment method | Minimum deposit (USD)* | Maximum deposit (USD) |

|---|---|---|

| Bank transfer | £1/€1 | No maximum |

| PayPal | £1/€1 | No maximum |

| Revolut | £1/€1 | No maximum |

| Wise | £1/€1 | No maximum |

| View more > | Yield App > |

What are the minimum and maximum withdrawals?

The minimum withdrawal is £10/€10, as that is the minimum fee to make a withdrawal. There are no maximums.

| Payment method | Minimum withdrawal | Maximum withdrawal |

|---|---|---|

| Bank transfer | £10/€10 | No maximum |

| PayPal | £10/€10 | No maximum |

| Revolut | £10/€10 | No maximum |

| Wise | £10/€10 | No maximum |

| View more > | Yield App > |

The withdrawal fee is 0.1% of the total amount, with a minimum fee of £10/€10

What are the deposit and withdrawal options fees, limits, and speeds?

A bank transfer is the most common way to deposit, but Yield App also accepts transfers from Revolut, PayPal, and Wise. Most withdrawals are completed within a few minutes but they can take up to 3 business days, depending on your bank.

| Payment method | Withdrawal fee | Withdrawal speed |

|---|---|---|

| Bank transfer | 0.1%/£10/€10 | Up to 3 business days |

| PayPal | 0.1%/£10/€10 | Up to 3 business days |

| Revolut | 0.1%/£10/€10 | Up to 3 business days |

| Wise | 0.1%/£10/€10 | Up to 3 business days |

| View more > | Yield App > |

Fees & costs

How do Yield App fees work?

Yield App applies spreads to any transaction you make on the exchange, while there is also a relatively steep withdrawal fee. There are no other fees.

| Fee | Yield App fees | Immediate Prime fees | Quantum Maxair fees |

|---|---|---|---|

| Trading fees | No | – | – |

| Inactivity fees | No | – | – |

| Rollover/overnight fees | No | – | – |

| Withdrawal fees | Yes | – | – |

| Spreads | Yes | – | – |

| Conversion fees | No | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

What are Yield App’s trading fees?

There are no trading fees on Yield App, but you may be charged through the spread.

| Asset | Yield App fees | Immediate Prime fees | Quantum Maxair fees |

|---|---|---|---|

| Crypto | Spread only | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

Platforms & usability

What devices can I use Yield App on?

Yield App works best through your web browser, but you can also download the app from Google Play or the App Store and use it on your mobile or tablet.

| Device | Browser/operating system |

|---|---|

| Web browser | Google Chrome, Microsoft Edge, Mozilla Firefox, Safari |

| Mobile app | iOS, Android |

| Tablet | iOS, Android |

| View more > | Yield App > |

Yield App mobile app review

The Yield App mobile platform offers all the same features as the main website, although it’s not quite as intuitive to use.

You can find all the features you’re likely to need on the app. The home screen gives you immediate oversight about how much is in your account, your recent earnings, and which assets you hold. From there you can swap between different cryptos, lock up your assets, and make deposits and withdrawals in more or less the same way as the main platform.

One of the big plus points is a second app, the Yield Pro Simulator, which is an educational app that teaches you about creating investment strategies and structured products so that you understand how to gain exposure to them without creating unnecessary risk. You can then test these structured products without leaving yourself vulnerable to losses.

Web trading platform

The most important question any user has is: How easy is it to use Yield App?

Yield App is designed to be simple and intuitive, and it meets that aim by offering an easy place to buy, sell, trade, and earn competitive yields. It’s easy to navigate between the two main products – Earn and the Swaps service – while connecting your bank account to the platform in order to make fast, convenient deposits.

Your account hub gives you all the relevant information about your assets, and it’s much easier to quickly invest in a new product on the web platform compared to the mobile version. Generally, we found it easier to manage our money on the full site, although the mobile version is a convenient way to keep tabs on how your investments are doing.

Key features

Market-leading rates

Yield App’s 11% APY on stablecoins is up there with any other digital asset platform. Though it requires a 365 day lock-up period to access the highest rates, even with flexible terms stablecoins pay up to 7% APY. Those yields are up there with anyone in the business.

High interest opportunities with Yield Pro

Yield App’s new Yield Pro range of structured crypto products offer higher returns for more experienced investors, who are willing to take on more risk. Currently, there are three structured products: sell-high dual currency and buy-low dual currency. Both of these add to the overall experience of Yield App as a platform for both new and more experienced investors.

Yield Pro Simulator

Yield Pro Simulator is the free educational app which helps you to understand the structured products available. You can use the app to test your market views and experience, create your own investment strategies, and familiarise yourself with new products without the financial risk of doing so for real.

Safety & reliability

Is Yield App safe?

Yes, Yield App offers a safe and secure wealth management experience thanks to a combination of sensible investment strategies and a preventative model that ensures it doesn’t take on too much risk.

The main way it reduces risk and keeps your funds safe is by not using leveraged products to invest. Leverage is how other, similar yield generation products have run into trouble in the past, but Yield App prioritises capital preservation above high yield returns by using a 135 point risk model to decide on its investments.

Ultimately, it means that Yield App is safe, as it’s a platform that doesn’t rely on constant market growth to generate returns.

Is Yield App regulated?

Yield App is fully registered as a Virtual Asset Service Provider (VASP) with the OAM in Italy. The platform recently announced plans to register in multiple regions as regulatory frameworks become more established.

| Region | Yield App regulators | Immediate Prime regulators | Quantum Maxair regulators |

|---|---|---|---|

| Africa | – | – | – |

| Asia | – | – | – |

| Australasia | – | – | – |

| Europe | OAM | – | – |

| International | – | – | – |

| North America | – | – | – |

| South America | – | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

Yield App customer support review

Beyond its FAQ centre, Yield App offers several customer support options, with live chat for all and either direct email support or via an email request form.

| Support type | Yield App customer support | Immediate Prime customer support | Quantum Maxair customer support |

|---|---|---|---|

| Help Centre/FAQs | Yes | – | – |

| Yes | – | – | |

| Live chat | Yes | – | – |

| No | – | – | |

| Telephone | No | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

What are the risks of using Yield App?

There are two main risks: that the platform you’re using goes bankrupt while your assets are stored on it and the fact that your assets can fall in value while you can’t access them.

Yield App has taken steps to prevent the first risk, by ensuring it only invests in unleveraged products. But it is always a possibility. Here are some of the main risks to consider when using Yield App.

- You don’t have custody of the assets you store on Yield App. If something happens to the platform, you may lose those assets.

- The value of the yield you earn may not be enough to make up for the fall in overall value of the digital asset. If the price of your assets goes down while they are locked into a 30 or 365-day product, you can’t access them.

- You must own a considerable amount of YLD tokens to access the best rates. This means you have a significant stake in the platform and a large portion of your overall wealth on it may be stored in YLD, a much more volatile product than stablecoins or a leading crypto like Bitcoin.

Research & analysis tools

What trading tools are on offer?

There are no real trading tools on offer beyond basic price charts for each cryptocurrency.

| Trading tool | Yield App tools | Immediate Prime tools | Quantum Maxair tools |

|---|---|---|---|

| Charts | Yes | – | – |

| News feeds | No | – | – |

| Analyst recommendations | No | – | – |

| Fundamental analysis | No | – | – |

| Financial calendar | No | – | – |

| MetaTrader integration | No | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

Charts

There are some price charts available when you make crypto swaps, but these are not on the same level as you would find on a dedicated charting or analysis platform.

Education & learning resources

What educational resources are on offer?

You can access a virtual trading platform through the Yield Pro Simulator, while the Yield App website offers walkthrough guides to help you get started with the platform.

| Educational resource | Yield App resources | Immediate Prime resources | Quantum Maxair resources |

|---|---|---|---|

| Demo/virtual account | Yes | – | – |

| Video tutorials/webinars | No | – | – |

| Walkthrough guides | Yes | – | – |

| Copy trading | No | – | – |

| Trading academy | No | – | – |

| View more > | Yield App > | Immediate Prime > | Quantum Maxair > |

Demo/virtual account

Through the Yield Pro Simulator you can try out different strategies and test structured products without risking any of your own money. But note that the main Yield App platform does not offer a demo account.

Walkthrough guides

The Yield App website contains a lot of useful information on how to get started, including detailed guides on how to make your first deposit or create your own virtual IBAN account, which allows you to make quick deposits from your bank account.

Yield App video review

Yield App customer reviews

Yield App is universally well-regarded by its customers, with a high rating across the board. In particular, the mobile app has proved popular with both Android and iOS users.

| Yield App reviews | Review rating |

|---|---|

| Trustpilot | 4.3 |

| Google Play Store | 5.0 |

| App Store | 5.0 |

Our verdict

Yield App is an excellent place to build your wealth by earning interest on crypto products. It’s a platform that has clearly put a lot of work into providing a safe way to earn competitive yields, which is no surprise given it’s backed by an experienced team with prior experience in traditional asset management.

The low minimum deposits and simple earn and swap products mean it’s perfect for anyone who’s new to the whole experience of earning interest on digital assets. Our only quibbles are the fact that accessing the very top rates of interest requires both a substantial investment in YLD tokens and a long lock-up period, which may not appeal to all users.

While we also found the onboarding verification process a little convoluted, as it required multiple forms of ID in order to sign up. Beyond that, however, Yield App offers a great way to start earning interest on crypto, and even the flexible, instant-access products offer competitive yields.

Who is Yield App suitable for?

It’s primarily suited to casual users who are looking for a simple way to earn extra money on their crypto holdings. The fact there are only a handful of cryptocurrencies available makes it simple to understand, while the focus on stablecoins and only the very top of the market makes it inherently safer and at less risk of running into trouble compared to some of its competitors.

More advanced users might find something they like in the Yield Pro platform, that offers structured crypto products and opens up the opportunity for higher returns. However, there are other services out there that support more cryptocurrencies and offer the potential for higher yields – though these come with commensurately higher risk as well.

Is Yield App good for beginners?

Yes, we would recommend Yield App to beginners as an ideal way to dip your toe into the crypto interest game. Once you create an account, it’s very easy to deposit money and swap it into crypto, while the flexible interest products mean you can try it out without the risk of locking your money up for a long time.

Our methodology

Helping people make better financial decisions is at the heart of our mission at Invezz.

We test each crypto interest platform to provide clear, accessible guidance on the service it offers and how it compares to the 63+ other platforms we review. Testing is carried out by our panel of crypto experts, analysts, and active traders who sign up to the platform, conduct research, and score the service.

To supplement our practical testing and experience, we research the digital asset platform to gather any further relevant information and provide context to help you decide whether the platform is right for your investing needs. We read online customer reviews, app reviews on the Play Store and App Store, and conduct user surveys to get feedback from real people about what works, and what doesn’t.

The platform is awarded a final score based on 130+ data points across 8 ranking categories: cost, reliability, user experience, deposit & withdrawals, investing options, range of products/markets, research & analysis tools, and the availability of educational & learning resources.

We work closely with the individual crypto brand to ensure all factual information displayed here is accurate. All data is then fact-checked by an independent reviewer. You can learn more about our expert panel and how we test, rate, and review platforms in our review process.

FAQs

Who owns Yield App?

Yield App was established in 2020 by Tim Frost, a key figure in the growth of notable fintech enterprises such as EQIBank and Wirex. Lucas Kiel, the platform’s CIO, boasts a background as a senior trader and managing director at Credit Suisse in Hong Kong. Meanwhile, COO Justin Wright brings hands-on involvement in crafting structured financial products and executing multi-asset class financial arbitrage.

How does Yield App make money?

Most likely, Yield App makes money by investing in safe crypto products which pay out a rate of interest, which it then passes on to its customers. The company can take a cut of this yield as its ‘fee’.

Does Yield App offer CFD trading?

No, Yield App is a wealth management platform where you can swap cryptocurrencies or earn interest on supported cryptocurrencies.

How do I delete my Yield App account?

You can delete your Yield App account by going to your account profile when logged into the platform. From there, there’s an option to delete your account,

Can I transfer from my Yield App account into my PayPal account?

Yes, Yield App accepts deposits to and withdrawals from PayPal.

Can I pay in cryptocurrency on Yield App?

Yes, you can deposit crypto onto Yield App.

Does Yield App offer bonuses?

Yield App offers a referral program where you get paid for referring your friends. Once they open an account using your referral link or code and invest $1,000 or more into an Earn+ portfolio, you both earn $25 in BTC.

Members who qualify for the Diamond Tier also qualify for higher rates of interest, three free withdrawals per month, and access to VIP live chat. Any YLD token holder gets early access to Haven1, it’s new Layer 1 blockchain.

Sources & references

Our editors fact-check all content to ensure compliance with our strict editorial policy. The information in this article is supported by the following reliable sources.

Risk disclaimer

Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always carry out their own research. The assets covered on this website, including stocks, cryptocurrencies, and commodities can be highly volatile and new investors often lose money. Success in the financial markets is not guaranteed, and users should never invest more than they can afford to lose. You should consider your own personal circumstances and take the time to explore all your options before making any investment. Read our risk disclaimer >

James Knight

Editor of Education

- Stock Market

- Cryptocurrencies

- Commodities

- Investing

- Sport