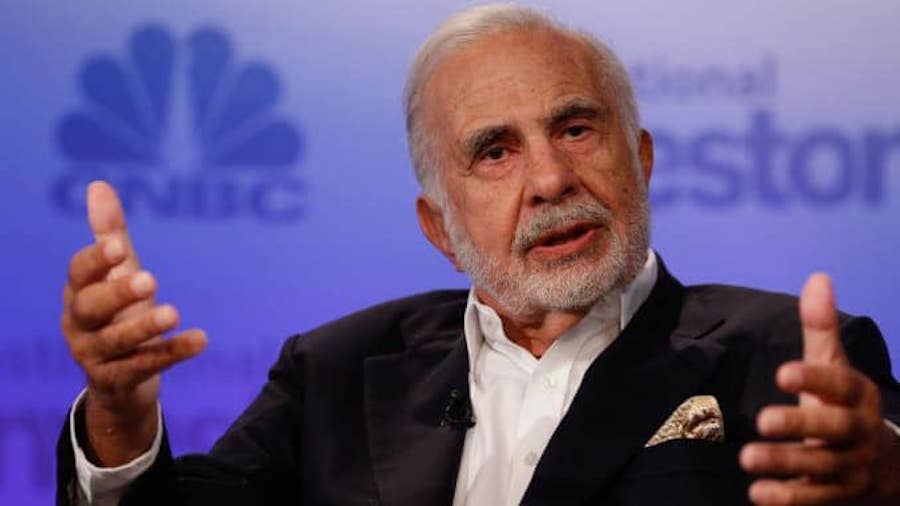

Is Carl Icahn ready to retire?

- Carl Icahn appears to be one step away from retirement.

- His son Brett rejoined the family office and will oversee a team of investment pros.

- Carl moved to Florida last year and is enjoyhing a semi-retirement lifestyle.

Billionaire legendary activist investor Carl Icahn is one step closer to retirement after his son Brett is rejoining the family office Icahn Enterprises LP (NASDAQ: IEP), The Wall Street Journal reported.

Succession plan

Copy link to sectionIcahn is 84-years old and has no immediate plans to leave his namesake firm. He will remain in charge of the family office that hasn’t accepted any outside money for several years and boasts a market value of more than $10 billion.

Icahn sure hasn’t lost a beat despite his tender age. You can read here a scathing letter he wrote in early February.

But now that Brett is rejoining the firm he left in 2016, the writing may be on the wall: the elder Icahn is enjoying his semi-retirement and looking to eventually wind down.

Carl moved from New York to Florida last year and hasn’t made any headlines with a new position, according to WSJ. He is enjoying his Miami beachfront estate where he plays tennis and enjoys an evening “quarantini” with his wife and their dogs. However, he remains active in the market and spends his evenings and weekends working.

Brett will manage a team of portfolio managers, pay $10 million to acquire a stake in the firm, and join the board of directors as part of a succession plan. Brett will succeed his father as chief executive and chairman of the investment segment within seven years.

In the meantime, Brett and his team will search for investment ideas that require the approval of Carl. Brett will also have to invest his own money into each investment idea.

Activism is in the DNA

Copy link to sectionBrett’s investment approach is similar to his dad’s: he likes to find undervalued or mismanaged companies and push for changes to help support the stock. After all, he learned from an expert, working for 15 years at Icahn Enterprises.

Icahn started working as a low-level analyst in 2002 and made his way up to oversee a $7 billion portfolio, according to WSJ. At the portfolio’s peak, it was generating an annualized return of 27%.

Icahn share performance

Copy link to sectionIcahn Enterprises’ stock is down 20% in 2020 as the pandemic impacted some of its holdings. Most notably, Occidental Petroleum Corporation (NYSE: OXY) saw its stock get hammered amid crashing oil prices while car rental company Hertz Global Holdings Inc (NYSE: HTZ) was forced into bankruptcy.

There were some bright spots in the quarter, but not enough to offset the losses. The firm pocketed at least $1 billion in profit after shorting the debt of mall owners. Currently, he is short several overvalued technology and retail stocks but on a smaller scale.

More industry news