OMFIF Global Public Investor 2023 surveys central bank reserve managers

- Reserve managers are facing one of the most difficult macroeconomic environments.

- Central banks are more reluctant to intervene in financial markets and manage currency volatility.

- Reserve managers are focusing on capital preservation.

The Official Monetary and Financial Institutions Forum (OMFIF) is an independent forum for central banking, economic policy and public investment and released its flagship Global Public Investor report earlier today.

This is the 10th edition of the annually released report which surveys reserve managers (RMs) from 75 central banks managing combined international reserves of nearly $5tn.

The report also ranked a total of 171 central banks by reserve assets with the People’s Bank of China being ranked first with international reserves amounting to $3,379 bn.

A short note on the report

Copy link to sectionThe report looks to delve into the perceptions of reserve managers particularly on their economic outlook, future investment plans and operational opportunities and challenges.

The task of the reserve manager has never been more challenging, given the shifting economic conditions, uncertainty around inflation, falling global growth, financial stability issues in several countries, as well as the added dimension of major geopolitical risks.

At the same time, ESG investments are a rapidly evolving area, while financial institutions are having to think ever more deeply about data collection, insights, and management.

Moreover, with central banks and national governments seeking alternatives to the dollar, the future of the global monetary system is itself unclear.

It should be noted that the survey reflects figures from 2022.

Key findings

Copy link to sectionSome of the important findings of OMFIF’s most recent survey are as follows:

Losses mean less intervention

Copy link to sectionThe report found that total global reserves slipped from $15.8tn in 2021 to $15.0 tn the following year.

Total reserves have been led lower by valuation effects, foreign exchange intervention, and elevated commodity prices causing RMs to be reluctant to risk intervening in financial markets.

The focus of these institutions has moved from volatility management and intervention to capital preservation and rebuilding their asset base.

Total reserves have slid in all regions with the exception of MENA due to tight energy markets and high oil prices in 2022.

Of key concern, 10% of central bank respondents found themselves having insufficient reserves.

These institutions are located either in Sub-Saharan Africa or Asia-Pacific.

Stagflation on everyone’s mind

Copy link to sectionThe report found that stagflationary concerns accelerated sharply, with the authors noting,

Almost 70% count a global economic slowdown among their top three concerns – over twice the share from 2022.

Crucially,

…not a single respondent expects inflation to fall to target in major economies in the next 12-24 months.

The report also notes that 38% of respondents expected a global recession in the next 12 months, and were not optimistic about the prospects of a soft landing.

Geopolitical dimensions

Copy link to sectionThere is little doubt that geopolitics has become an incredibly important consideration for RMs, particularly over the last couple of years.

With tensions in the US-China relationship, Russia’s invasion of Ukraine and the subsequent sanctions, the Taiwan situation, global fragmentation, and ever more economies looking to decouple from the dollar, 83% of RMs noted this as a top-3 concern over a 5–10-year horizon.

Having said that, with tensions in Ukraine and Russia having somewhat relaxed last year, geopolitics was not so crucial a near-term consideration.

In 2022, 85% of respondents noted it as a top-3 near-term consideration whereas this fell to 51% in this report.

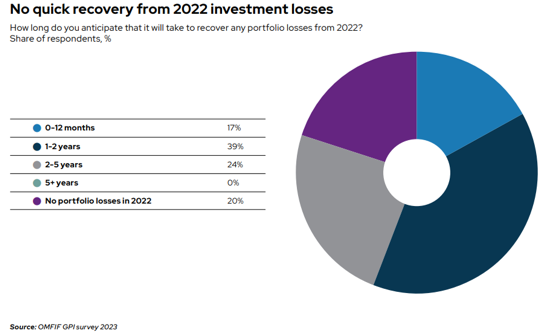

No hope for a quick recovery

Copy link to sectionPerhaps most concerning is the lack of expectation of a near-term turnaround that could help recoup deep losses from 2022.

As per OMFIF, 80% of RMs suffered losses in their portfolios last year, with 24% of respondents expecting that it shall take 2-5 years to recover those investments.

In addition, RMs are highly risk averse, with the report noting,

Capital preservation is the primary investment objective for 69% of respondents, up from 61% in 2022.

In fact, less than 7% of respondents planned to increase equity or corporate bond holdings in their portfolio in the coming years.

In such circumstances, RMs have been much more interested in acquiring traditional reserve assets over the coming two-year horizon.

The focus has squarely been on high-quality government bonds, quasi-government bonds and gold, with a net 32%, 20% and 14% of respondents looking to increase these assets in their portfolio over the next 1-2 years, respectively.

Trends in government and quasi-government paper followed improved yields among fixed-income assets.

63% of those investing in the yellow metal, do so for diversification benefits, while 35% are hedging against geopolitical risks.

Asset-backed securities, real estate, infrastructure plays and cash drew comparatively low levels of interest (net).

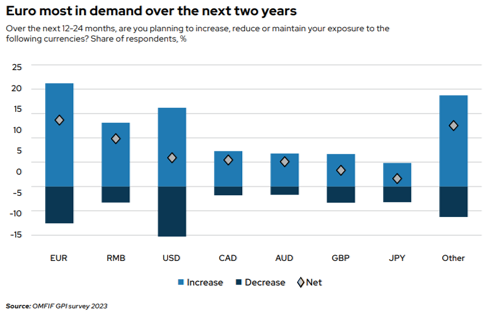

The dollar remains king of currencies

Copy link to sectionGiven the prevailing macroeconomic outlook, uncertainty in the Chinese growth story, and expectation of more dollar rate hikes, respondents viewed the RMB with lesser enthusiasm as a source of diversification in the near term.

In 2021, 30% of RMs surveyed were keen to add to their RMB holdings in the next 1-2 years, but this fell sharply to 13% in the current survey.

Greater transparency and geopolitical issues were found to be the primary concerns of RMs in this regard.

However, nearly two-fifths of respondents saw the RMB as a viable addition over a ten-year horizon, a higher proportion than any other currency.

Yet, the RMB’s rise is expected to be very gradual, with respondents believing its share in global reserves shall increase from the current 3% to 6% over a ten-year period.

Nearly another two-fifths are looking to maintain their current exposure to the RMB over the long term.

Dollar

On average, RMs anticipated that the greenback’s position of 60% of global reserves shall be scaled back to 54% over the coming decade.

Thus, the majority of RMs expect de-dollarization to proceed relatively slowly.

As Mark Sobel, US chair, OMFIF, noted,

Inertia reigns. If it ain’t broken, why fix it?

The greenback’s reserve currency position comes with benefits such as inexpensive borrowing.

At the same time, the US can suffer from persistent trade deficits, subdued growth and an overvalued currency.

Negotiating these challenges is key to sustaining its reserve currency advantages.

Sobel believes that the most significant threat to the dollar comes from the potential for US mismanagement itself.

Interested readers may wish to explore a piece on the challenge that US states are posing to the dollar by re-recognizing gold and silver as legal tender.

Euro

Interestingly, in the near-term, i.e., 1-2 years, the euro is the most attractive vehicle for diversification for most RMs.

The popularity of the euro has soared since the previous survey.

In 2021, a net 0% of RMs looked to allocate capital to the euro, while in the current survey, this has risen to 14%.

Speaking at the launch of the report, Frank Scheidig, Global Head, Senior Executive Banking, DZ BANK, noted that he believes that the euro may see an influx of more liquidity, resulting in its share as a part of reserve assets rising to 25% or even higher.

The report also notes the euro’s long-term potential,

Moreover, a net 9% of central banks expect to increase their euro holdings over the next 10 years, suggesting the currency may play a key role in diversification strategies away from the dollar in the medium to long run.

Sustainable assets and operational challenges

Copy link to sectionIn addition, RMs are still showing strong demand for sustainable assets, with nearly 40% of respondents looking to increase their green bond holdings in the next 1-2 years.

European RMs have the highest demand for green bonds at 61% but these products are seeing interest across all regions, including MENA where survey respondents currently hold no sustainable assets.

Yet, the report found that as inflationary and growth concerns deepen, issues such as climate change and their associated management are of lower immediate importance.

Lastly, OMFIF found that 58% of respondents marked recruitment and training as a key operational challenge for increasingly complex roles.

In fact, 74% of RMs noted retaining external managers to aid in the management of sophisticated reserve assets.

Conclusion

Copy link to section85% of respondents list inflation as a top-3 priority; 38% expect a recession within a year; 64% expect it shall take over a year to recover the incurred losses; while 10% of central banks suffer from insufficient liquidity.

Global reserves have dropped by 3% since last year, while RMs are forced to contend with stagflation, geopolitical tensions, ESG-led pressures and the potential of a shift in the global monetary framework.

This a highly challenging environment for RMs who are also suffering from a lack of sufficient skilled staff.