VinFast stock price forecast: FOMO rally to end badly

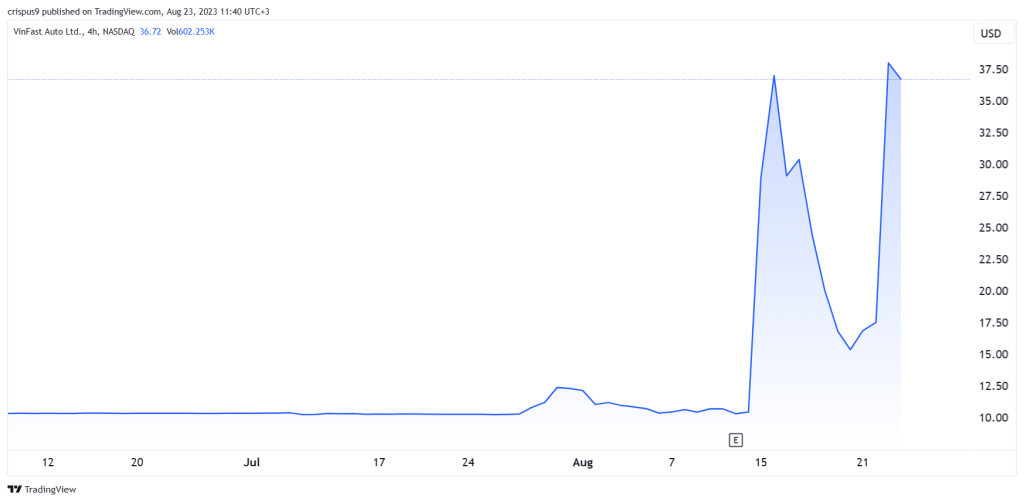

- VinFast share price has gone parabolic in the past few days.

- It has a valuation of $90 billion, bigger than GM and Ford.

- The stock will likely plunge in the long term.

VinFast (NASDAQ: VFS) stock price is defying gravity as the electric vehicle company gains momentum. The shares doubled on Tuesday and reached its all-time high of $48, giving it a market cap of over $90 billion.

VinFast stock price chart

EV bubble is bursting

Copy link to sectionVinFast, which I first wrote about here, has become a popular EV stock among day traders. They are simply attracted to the overall hype, which has led to a fear of missing out (FOMO).

VinFast’s valuation makes no sense for an unprofitable company in a highly crowded market. General Motors and Ford, which are well-known brands that sell millions of vehicles each year have a combined market cap of $92 billion.

In addition to its valuation, there are signs that the EV bubble is bursting. In China, the number of EV companies has dropped from over 400 to under 100. Companies like Tesla and Nio have resulted to price cuts in a bid to boost demand.

The same trend is happening in the United States. Recent data shows that EV companies like Ford and GM are struggling to sell their EV cars, with Ford having to slash its EV production. It had 116 days of unsold Mustang Mach E

Further data shows that EV inventory has risen to 103 days of supply, double that of ICE cars, The average EV price has dropped by 20% on a year-on-year basis to $53.4k.

Macro numbers are also not encouraging, with US interest rates surging to the highest level in over 20 years. Auto loans have risen while delinquencies in the industry have started rising.

These metrics are important for VinFast since its ultimate goal is to become a leading player in the American EV industry.

Is it safe to buy VinFast stock?

Copy link to sectionI believe that VinFast is a high-risk stock to invest in for long-term investors. First, we have been here before. A few years ago, Rivian stock price surged, pushing its total market cap to over $100 billion. Today, while Rivian is selling thousands of cars, its valuation has slipped to below $20 billion.

Also, we saw the remarkable rise of meme stocks like AMC, GameStop, and Bed Bath & Beyond (BBBY). Today, BBBY has already filed for bankruptcy while other similar companies are struggling. I think VinFast will follow the same trend.

Most importantly, history suggests that running a successful EV company is hard. Nikola has warned about its ability to continue as a going concern while Lordstown Motors has already filed for bankruptcy. I have warned that Mullen Automotive could be on the verge.

Despite all this, it is extremely difficult to short the company since anything can happen for now. In the long term, however, VinFast stock short-sellers will be rewarded.

More industry news