IYR and SCHH ETFs outflows rise as real estate outlook darkens

- Real estate ETFs stocks have retreated sharply in the past few weeks.

- There is a rising fear of a wall of maturities in the coming few years.

- A rotation from value to growth is continuing.

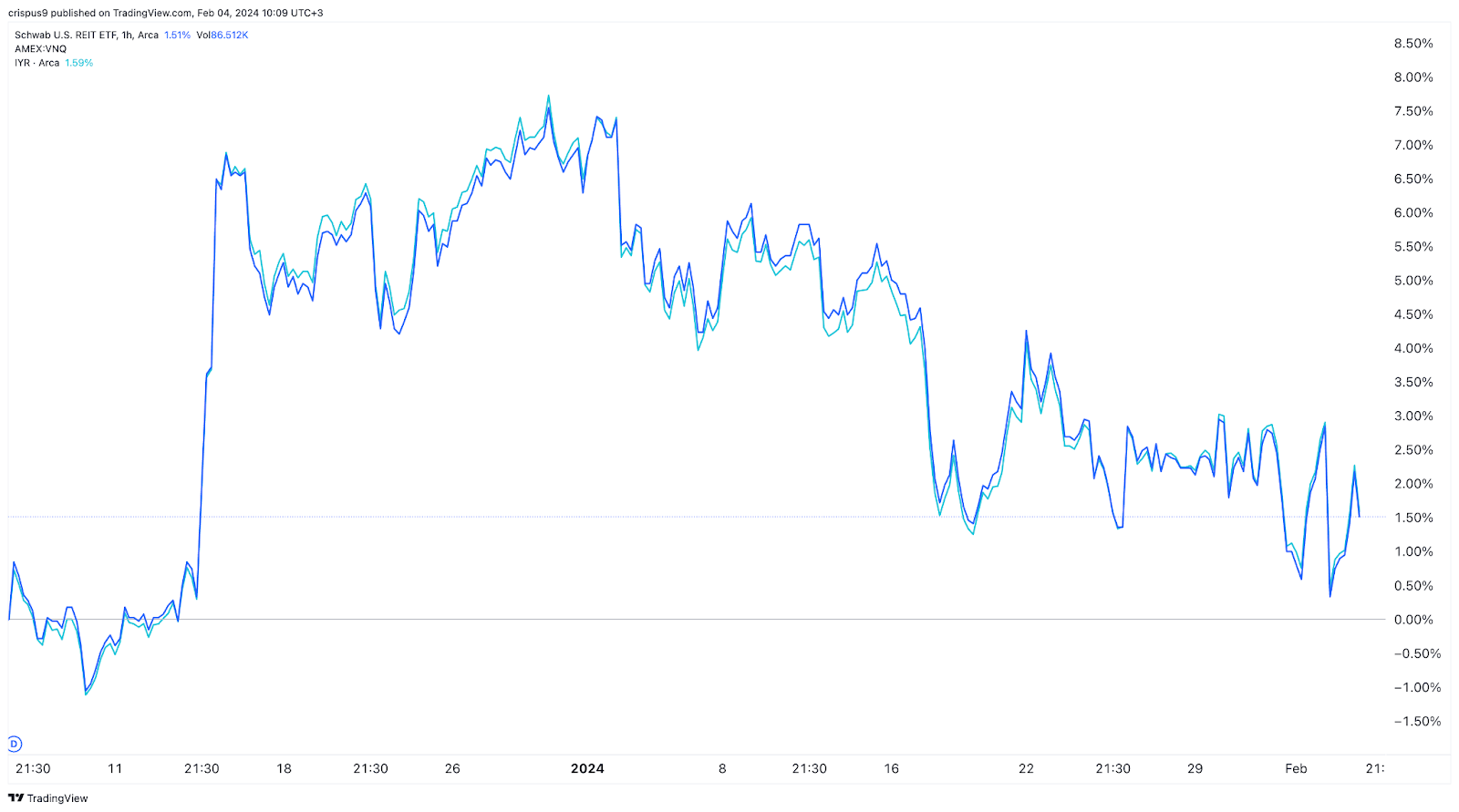

The iShares US Real Estate ETF (IYR) and the Charles Schwab US REIT ETF (SCHH) came under pressure last week as concerns about real estate valuations and high-interest rates rose. IYR, SCHH, and VNQ, ETFs that track the industry have dropped in the past three straight weeks as outflows have risen.

IYR vs SCHH vs VNQ stocks

REIT ETFs are seeing outflows

Copy link to sectionData compiled by ETF.com reveals that the iShares US Real Estate ETF has lost over $154 million in assets this year while the SCHH fund has lost $51 million. The latter fund has had outflows in the past two straight weeks. The only real estate ETF to have inflows was the Vanguard Real Estate ETF (VNQ).

Real estate stocks woes came under more pressure last week after the Federal Reserve hinted that rate cuts will not happen in March. The worries accelerated after the strong US nonfarm payrolls numbers. As a result, some analysts see no need for rate cuts since the Fed has successfully engineered a soft landing.

Therefore, a combination of higher-for-longer situation and low occupancy rates in key office cities are major headwinds for real estate companies. Just recently, several companies like Twitch, Hasbro, Levi’s, and Duolingo have announced major layoffs. This means that many companies will seek friendlier terms when their leases expire.

Wall of maturities is nearing

Copy link to sectionAll these factors are coming at a time when the real estate industry is bracing for a wall of maturities. This is a situation where loans that were taken in a low-interest rate environment come due in a period when rates are at their 22-year high. As such, it will become difficult to refinance these loans.

The other big risk facing real estate REITs is the ongoing rotation from value stocks to growth as their performance jumps. The Nasdaq 100 index, which tracks the biggest technology companies, has jumped to a record high. Similarly, the S&P 500 index, which counts tech as the biggest component, has also continued to thrive this year.

Popular ETFs have continued seeing strong inflows. The iSharess Core S&P 500 ETF added over $4 billion while the ishares S&P 500 Value ETF (IVE) had the biggest inflows last week.

More industry news