EasyJet share price always beats British Airways’ IAG: Here’s why

- IAG and EasyJet are some of the biggest airline stocks in the UK.

- EasyJet has a long track record of beating IAG, the parent company of BA.

- It is a simpler company with a better balance sheet and a growing franchise.

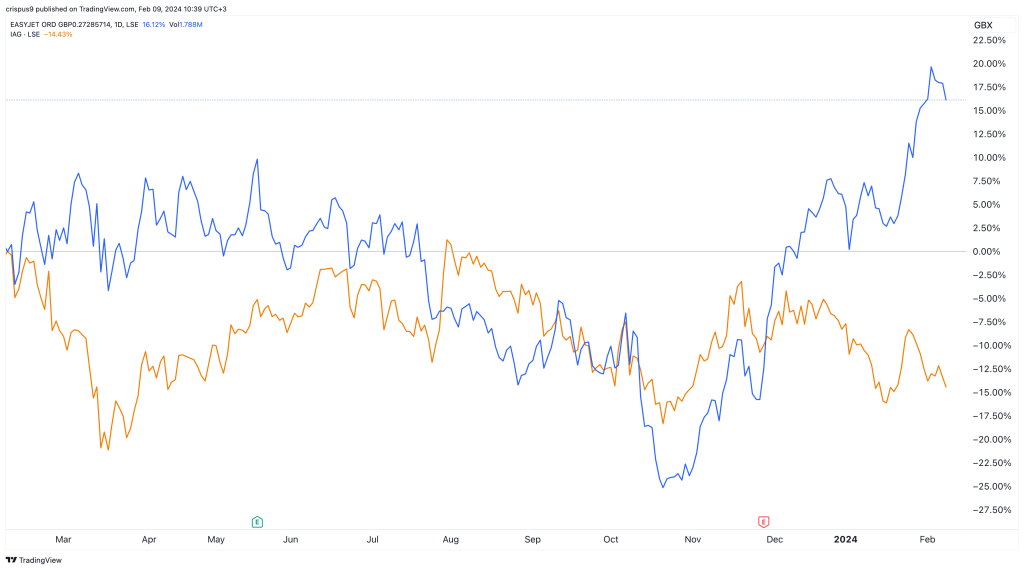

In 2022 and 2023, I wrote articles comparing EasyJet (LON: EZJ) and IAG (LON: IAG), which you can read here and here. In these articles, I concluded that EasyJet was a better investment by far. This view has worked out well as EasyJet has jumped by more than 16% in the past 12 months while IAG has fallen by over 15%. This article explores why EZJ always beats IAG.

IAG vs EasyJet share prices

EasyJet is a simpler airline than IAG

Copy link to sectionThe most obvious reason why EZJ does better than the parent company of British Airways is that it is a simpler company. In this, it is a regional company that does not have the bureaucracy that IAG has. For example, the firm only uses Airbus planes, which ensures that it has lower training costs than IAG. IAG, on the other hand, has a variety of planes across its numerous brands.

This approach also explains why Ryanair has become the biggest airline globally by market cap. It has a valuation of over $31 billion, making it bigger than Delta and United Airlines. It also explains why Southwest has become the third-biggest airline globally.

IAG and its conglomerate discount

Copy link to sectionIn the past, investors loved to invest in conglomerates because of their diversification. Recently, however, these conglomerates have become unloved, which explains why many of the past ones are now separating. For example, General Electric has already separated its GE Healthcare business and is about to break its energy business. The resulting company will focus on the aviation industry.

IAG can be seen as a conglomerate because of its operational structure. In addition to British Airways, the company also owns Vueling, Iberia, Aer Lingus, LEVEL, and IAG Cargo. While its headquarters is in London, the company has other hubs in Spain. All this leads to bureaucracy, which affects its valuation. EasyJet, on the other hand, is a leaner organisation with about 16,000 employees while IAG has over 59,000.

EasyJet has a better balance sheet

Copy link to sectionFurther, EasyJet has a better balance sheet than IAG. The most recent results showed that EasyJet had over 1.9 billion pounds in cash and money market deposits. This was notable since it repaid its 500 million in debt during the last quarter. It has a net debt of just 50 million pounds. A better balance sheet is ideal now that interest rates have remained at an elevated level this year. It also means that the company does not direct most of its revenue to clear its debt.

IAG, on the other hand, is more indebted. It had over 9.8 billion in cash, equivalents, and interest-bearing deposits in the last quarter. It also had over 17.2 billion euros in borrowings, which is substantial.

These reasons, together with the fact that EasyJet’s revenue is growing at a faster pace than IAG explain why it is still a better investment.

More industry news