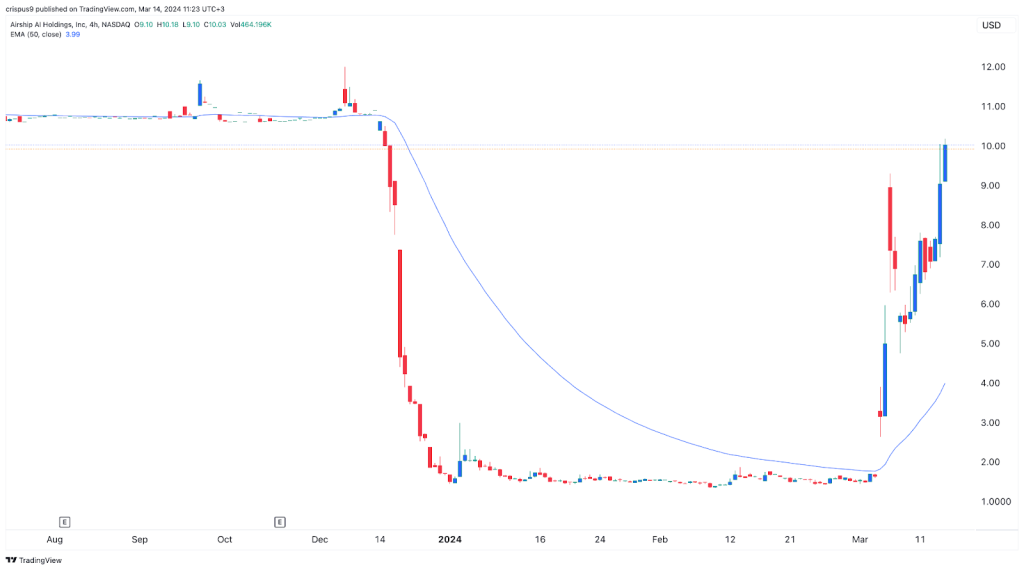

Airship AI CEO bought stock in January: AISP is up 665% since then

- Airship AI Holding's share price has surged by 665% from the YTD low.

- The company’s CEO bought a stock worth $150k in January.

- Insiders hold about 52% of the company.

Airship AI Holdings (NASDAQ: AISP) stock price has joined the artificial intelligence (AI) train. It has gone vertical, rising by more than 665% from its lowest level this year. This makes it one of the top-performing companies in Wall Street in 2023.

CEO bought the stock in January

Copy link to sectionI wrote about the recent AISP stock surge in this article. In this report, I noted that the stock surged after winning a contract from the US Department of Justice (DoJ). It beat other companies, including giants like RTX (Raytheon) for the video surveillance contract, which is worth millions of dollars.

Turns out, the company’s CEO, Victor Huang, was bullish on the company before the contract came in. Huang purchased stock in the company worth $150k, meaning that he has realised substantial returns since then.

This insider purchase was uncovered by Quiver Quant, which tracks insider and politician transactions in the US.

Insider transactions are often some of the best indicators of whether to buy or sell stocks. In most cases, stocks that have more insider purchases tend to do well than those that insiders are dumping.

A good example of this is Atlassian, the Australian parent company of Jira and Trello. Its stock has plunged by more than 20% from its highest level this year. As I have written before, its insiders, including the two CEOs have been actively selling the stock.

Airship AI Holdings’s insiders seem to be highly confident in the company. Data shows that insiders hold about 52% of the combined company. According to Yahoo Finance, the company is not held by most hedge funds and institutions.

AISP stock chart

Airship AI Holdings demand is rising

Copy link to sectionAirship AI Holdings hopes that its business will continue doing well as demand for video surveillance rises around the world. The benefit of its technology is that it is infused with strong AI capabilities, which are essential for law-enforcement officers.

The company has a long relationship with the US government. In December, the company started to deliver a $10 million order for the Department of Homeland Security (DHS). The DHS uses its technology mostly along the US border, which is being overrun by migrants.

The firm will likely continue seeing strong demand as the government focuses on border security, which has become a major security issue. This market size could soar to over $80 billion in the next few years. Therefore, there is a possibility that the stock could continue doing well as the AI craze continues.

More industry news