As gold price spikes, is it a good idea to invest in gold IRA?

- Gold price has surged to a record high of over $3,400 this year.

- It is having numerous tailwinds like inflation and REPO Act.

- Gold IRA advertisements are soaring, especially in the conservative media.

Gold price has surged hard this year, making it one of the best-performing assets in the market. It soared to a high of $2,450 last week, higher by over 33% from its lowest point in 2023. It has joined other assets like stocks and crypto that have soared to their all-time highs.

Why the gold price is soaring

Copy link to sectionGold is facing numerous tailwinds. Chinese investors are buying gold in record numbers after the country’s stocks plunged earlier this year. The government is also accumulating substantial amounts of gold as it seeks to cushion itself from the US and European sanctions.

The recently passed REPO Act that uses Russian assets to fund the war in Ukraine has accelerated the process. European countries are also considering enacting a similar law. While it applies only on Russia for now, it will likely be expanded to China if it invades Taiwan.

Second, there are substantial concerns about American debt, which is soaring by a whopping $1 trillion every 1115 days. The country has over $34.6 trillion in debt and the figure will get to over $40 trillion in the next few years. Therefore, investors believe that gold is a safer investment than the greenback.

Further, inflation has been a thorn in the flesh recently. While inflation growth has slowed, prices have still surged by over 27% in the past three years and this trend will likely continue in the coming years. Gold is often seen as a good hedge against inflation.

Additionally, gold funds are seeing robust asset growth. The popular SPDR Gold Trust (GLD) ETF has accumulated assets worth over $60 billion.

Gold price chart

The allure of gold IRA

Copy link to sectionThe recent surge in gold prices has led to more demand for gold IRA advertisements that target retirees. These companies promise users that their products are great hedges against inflation and the collapse of the American economy. They also argue that these IRAs have tax benefits since withdrawals are often tax-free.

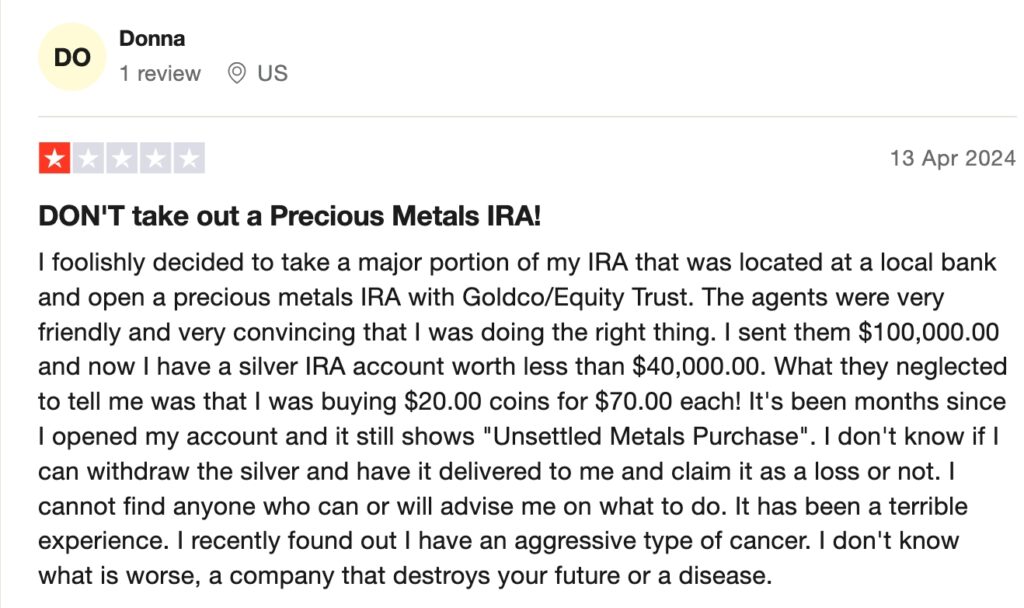

However, there are several reasons why investing in gold IRAs is not ideal. First, the industry is known for its scams. For example, a company known as Regal Assets collapsed recently, costing investors millions of dollars. Lawsuits allege that Tyler Gallagher, its founder, used the funds to buy luxury items.

Second, while it is true that gold IRAs have benefits, the reality is that their costs make it highly unreasonable. For example, a company like Hartford Gold charges an application fee of $230 and $200 annual maintenance fee. Therefore, if you hold your gold with them for 20 years, you will pay over $48,000 in fees.

Most companies like Rosland Capital, GoldCo, and Lear Capital charge at least $100 in annual fees. They also require a minimum deposit, which is often $5,000. Additionally, their gold is usually more expensive than in the spot market.

Gold IRA reviews

Therefore, I believe that the best way to approach gold is to invest in gold ETFs like the SPDR Gold Shares (GLD), Ishares Gold Trust (IAU), Physical Gold Shares ETF (SGOL), and the Sprott Physical Gold Trust (SGOL).

These funds charge a small fee, often less than 0.50%, which is highly affordable. They are also highly liquid, meaning that you can buy and sell them like stocks. That is a better approach than buying physical gold, which is often illiquid and insecure.

More industry news