Why is China avoiding US soybeans despite Brazil shipment delays?

- China's soybean imports fell due to delays in Brazil's soybean harvest, despite increased imports from the US.

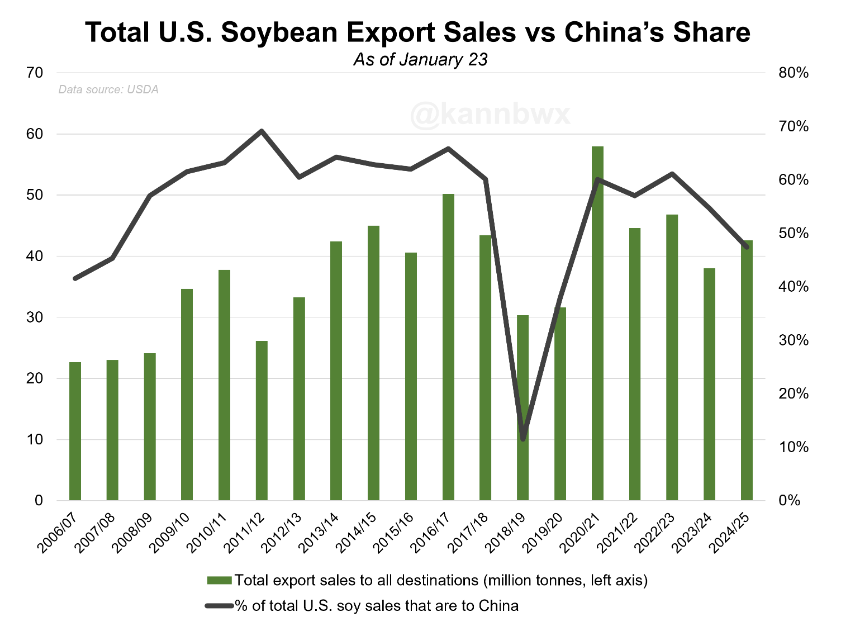

- US soybean exports to China saw a temporary surge in mid-January but remain below average.

- Brazil's soy exports are expected to recover in February, potentially impacting US soybean exports.

Delays in the soybean harvest in Brazil have resulted in slower than expected deliveries to buyers.

China receives over 70% of Brazil’s yearly soy exports, yet it seems unconcerned by the situation, Reuters reported on Friday.

The export window for US soybeans can sometimes be widened by a delayed Brazilian harvest, but recently, both overall shipments and participation from China have been sluggish.

Only a temporary surge in US soybean exports

Copy link to sectionUS soybean export sales to China saw a temporary surge in mid-January; however, weekly volumes over the past few months have generally been below average, even when measured against relatively moderate expectations.

US export sales to China for the 2024-25 marketing year reached a 17-year low, excluding trade-war periods, making up just 47% of all bookings as of January 23, Reuters said.

An additional 9% of sales are assigned to unknown destinations, which is within the normal range and does not suggest that Chinese purchases are being concealed, according to the report.

The US Department of Agriculture predicts that China’s 2024-25 soy imports will decrease year-on-year. Similarly, current Chinese bookings of US soybeans have also dropped 3% compared to last year.

China’s imports of soybeans have recently experienced a significant decline.

This decrease is primarily attributed to reduced shipments from Brazil, a major soybean exporter to China.

Despite an increase in soybean imports from the US during the November-December period, the overall import figures for China fell by 15% compared to the same period in the previous year, according to the Reuters report.

This shortfall in soybean imports is notable, especially considering China’s substantial demand for soybeans as a key ingredient in animal feed and a source of edible oil.

The decline in imports from Brazil could be due to a variety of factors, such as weather conditions affecting crop yields, logistical challenges, or changes in trade policies.

The increased imports from the US partially offset the decline from Brazil, but were not sufficient to maintain China’s overall import levels at their previous heights.

This situation highlights the vulnerabilities of relying heavily on specific countries for crucial commodities and the potential impacts of fluctuations in trade flows on a country’s food security and economic stability.

Increasing demand from hog sector

Copy link to sectionChina’s agriculture minister recently announced that the country’s hog sector has recovered from a period of unprofitability, which should theoretically bolster soybean demand.

Additionally, soybean crush margins in China have improved lately.

Coupled with the recovery of China’s hog sector, this news provides a positive counterpoint to the concerns stemming from the delays in Brazil.

Recent data on US soybean exports does not support the notion that China has been stockpiling the US beans in anticipation of future trade tariffs, Reuters said.

This and other factors make it difficult to put a positive spin on China’s recent involvement in the US soybean market.

Brazil January exports

Copy link to sectionBrazil’s January exports were significantly lower than both last year’s figures and earlier projections.

As a result, the number of Chinese arrivals may continue to be low for several more weeks.

Brazil’s soy exports in February are expected to be higher than average, and could even reach the same level as last year, despite delays in harvesting.

This is because shipping lineups indicate high export volumes, and Brazilian bean supplies will be plentiful and competitively priced from next month, according to Reuters’ report.

The US has seen a 30% increase in soybean sales to non-China destinations compared to last year, with sales to Europe being particularly high.

This positive news comes despite the USDA’s lower-than-average export forecast for 2024-25.

Overall, US soybean sales for the current date are the third-highest ever for non-China destinations, Reuters said.

But, China still accounted for 54% of all US soybean exports in 2023-24 and remains a crucial importer.

However, this trade flow could be further jeopardised as US President Donald Trump considers imposing tariffs on Chinese goods, potentially as early as this weekend.

More industry news