From factory to port: how Trump’s tariffs are reshaping global shipping

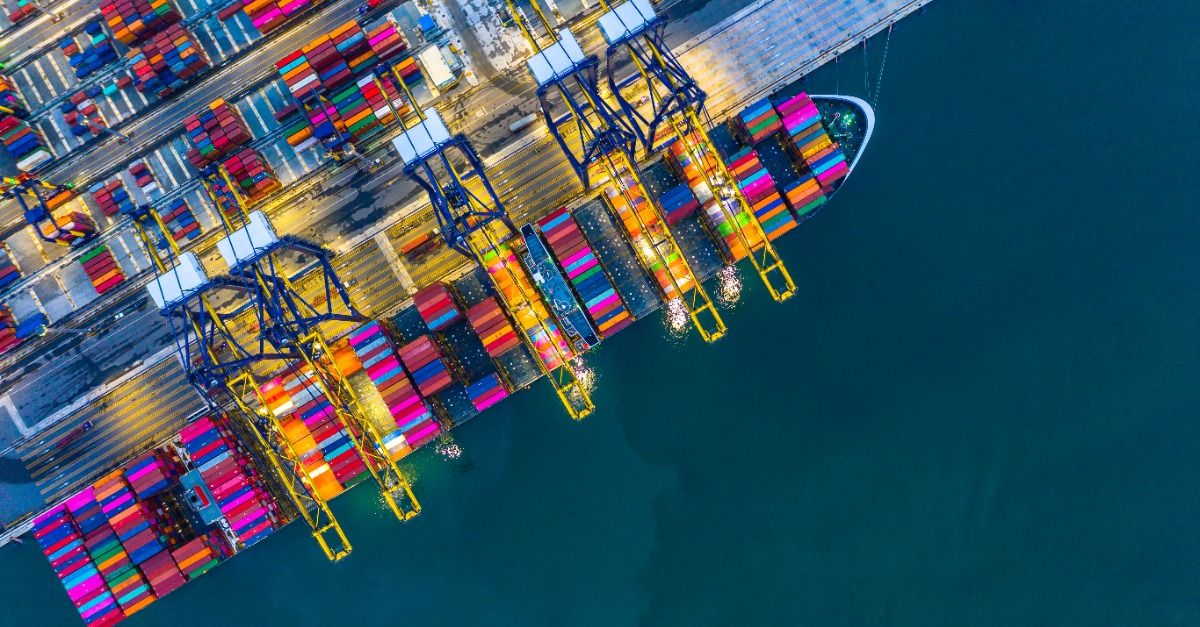

- Renewed US tariff threats trigger global scramble by suppliers to expedite or reroute shipments.

- Short-term shipping spot rates and air freight costs spiked significantly due to tariff uncertainty.

- Short-term shipping spot rates and air freight costs spiked significantly due to tariff uncertainty.

The specter of costly trade tariffs, once a painful memory for businesses like UK advanced materials manufacturer Goodfellow, has returned to haunt global supply chains.

During Donald Trump’s first term, a sudden levy on steel and aluminum added roughly £100,000 to a single shipment mid-journey across the Atlantic. That sting hasn’t been forgotten.

This time, as threats of new second-term tariffs loomed, the Cambridge-based company saw clients proactively seeking ways to expedite orders.

“We had conversations with people about whether [orders] could be sped up to pull them forward,” Andrew Watson, Goodfellow’s chief financial officer, acknowledged the limitations imposed by manufacturing lead times in a report published by The Guardian.

This sense of déjà vu, and the scramble to get ahead of potential cost hikes, has played out across countless industries worldwide in recent weeks.

Navigating the tariff maze

Copy link to sectionSuppliers globally rushed to move goods into the US before Trump’s anticipated “liberation day” announcement, a frantic effort to shield margins from potentially crippling duties.

While the White House eventually announced a 90-day pause on additional tariffs for most countries except China, the damage was arguably done.

The established rhythms of international commerce have been thrown into disarray, leaving a trail of market turmoil and deep uncertainty.

The sheer scale of the initially proposed tariffs caught many off guard, forcing manufacturers – from car parts producers to chocolatiers – into reactive measures.

Companies scrambled to shift extra stock or reroute products entirely, causing noticeable spikes in the cost of short-term shipping contracts and air freight as capacity tightened. Swiss chocolate giant Lindt & Sprüngli, for instance, preemptively sent additional inventory from its US factory in New Hampshire to Canada to circumvent retaliatory Canadian tariffs.

A spokesperson confirmed to the same publication that Lindt was “evaluating our global sourcing strategy for Canada to safeguard supply.”

Short-term spikes, long-term shifts

Copy link to sectionThis volatility was immediately reflected in shipping costs.

Peter Sand, chief analyst at Xeneta, informed The Guardian, that the industry dynamic: “The huge amount of uncertainty always brings around opportunities for carriers to take advantage of an unfortunate situation… often by hiking rates.”

Data from the shipping analytics firm illustrated this point sharply.

On April 1st, average spot rates for a standard 40ft container (FEU) from China surged 9% to $322 for the US East Coast and a significant 16% to $383/FEU for the West Coast.

Air freight felt the pressure too, with spot rates from Vietnam to the US climbing 8% and from China to the US rising 5% in the first week of April.

While spot rates are expected to remain choppy in the near term, prompting ports to brace for potential congestion, analysts foresee a different long-term picture.

As the US and China remain entrenched in their escalating trade dispute, demand for shipping between the two economic powerhouses is predicted to slump, likely pushing down longer-term contract rates eventually.

Congestion builds as contracts hang in the balance

Copy link to sectionCompounding the immediate disruption, tariffs on specific goods like steel, aluminum, and cars were not included in the 90-day reprieve. This prompted immediate action from major auto manufacturers.

Jaguar Land Rover and Audi temporarily halted US-bound exports, creating instant bottlenecks at key transport hubs.

Bremerhaven in Germany, one of the world’s largest vehicle handling ports processing 1.5 million vehicles annually, reported “a slight increase in export stock.”

While its owner, BLG, insisted space remained available, it conceded that carmakers and shippers were making “short notice” decisions about which vehicles would actually board US-bound vessels.

This turbulence strikes at a particularly vulnerable moment for importers.

March and April are traditionally when US companies lock in crucial annual long-term shipping contracts, set to commence May 1st. These contracts are vital for businesses needing reliable, cost-effective transport for large volumes.

“The timing couldn’t be any worse,” stated Xeneta’s Peter Sand.

Many are holding back if they can and relying more on the spot market, avoiding locking themselves into contracts for volumes on trade lanes that may not be profitable to them a week or a month from now.

Trade diversion and dumping fears

Copy link to sectionBeyond the short-term scramble, businesses are embarking on the complex, often multi-year process of rethinking their supply chains.

The goal is to reduce exposure to tariff-affected routes, but as experts warn, finding alternative suppliers and establishing new networks isn’t a simple switch.

Businesses are “trying to understand the ramifications of how to manage their supply chain,” observed Marco Forgione, director general of the Chartered Institute of Export & International Trade.

He anticipates significant “trade diversion” as companies seek growth in other markets away from the US.

This diversion carries its own risks, particularly for regions like the European Union.

Experts warn that without swift action to reinforce its own trade barriers, Europe could become a recipient of surplus Chinese goods unable to enter the US market – effectively, a dumping ground.

The port of Antwerp-Bruges in Belgium has already been wrestling with massive influxes of Chinese electric vehicles for months, even before this latest tariff wave.

“The UK, and others, will need to strengthen their guard against an increased focus from Chinese suppliers who have to dispose of product originally intended for the US market,” Ian Worth, a customs director at Crowe, advised The Guardian.

While potentially lowering consumer prices short-term, such dumping could harm domestic manufacturing efforts.

A new storm brewing: proposed port fees

Copy link to sectionAdding another layer of complexity, a separate proposal from the Office of the US Trade Representative (USTR) threatens further disruption.

Costly port fees, potentially around $1 million per call, have been suggested for Chinese-built ships docking at US ports.

Aimed at revitalizing American shipbuilding, the measure targets the reality that most major global shipping lines rely heavily on Chinese-manufactured vessels.

The proposal triggered significant industry backlash, with warnings that it would inflate consumer prices, harm US agricultural exports, and jeopardize dockworker jobs if ships reduced their US port calls (currently averaging four per voyage from Asia).

While the USTR has reportedly indicated it is reconsidering the fees, with more clarity expected soon, it represents yet another potential upheaval.

For now, the only certainty for businesses navigating the currents of global trade is continued, pervasive uncertainty.