Is it safe to buy Meta (Facebook) stocks after plunging >20% on earnings miss?

- Meta Platforms (NASDAQ:FB), Facebook’s parent, reported its Q4 FY2021 results yesterday after market hours.

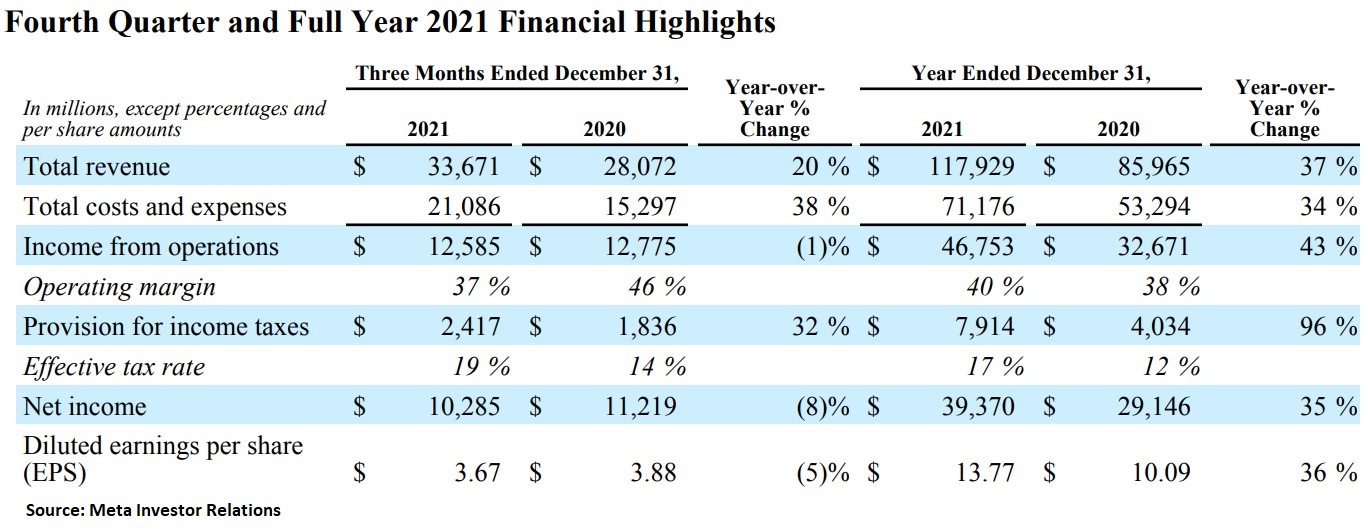

- See the Highlights of Meta’s Q4 2021 report

- Investors were surprised to find out that Facebook’s user numbers have shrunk for the first time.

Meta Platforms (NASDAQ:FB), Facebook’s parent, reported its Q4 FY2021 results yesterday after market hours. The stock plunged more than 20% on earnings miss and weak guidance.

One of the most awaited earnings conference call this week was Meta Platforms, Facebook’s parent company. The tech giant missed earnings expectations badly, decoupling from its rivals which have easily reported stronger earnings and strong future guidance.

As a result, the stock price plunged by more than -20% as investors were spooked by intensifying competition, weak guidance, and the earnings miss. Moreover, Q4 user growth fell short of expectations too.

The stock’s plummeting led to the company losing $180 billion in market share.

Highlights of Meta’s Q4 2021

Copy link to sectionWhile the company did report higher YoY revenues by 20%, its total costs and expenses grew even faster – up 38% YoY. As such, income from operations declined by -1%.

Another negative twist in yesterday’s earnings call came from net income and diluted earnings. Meta reported declining net income by -8%, which led to a corresponding -5% in diluted earnings per share.

Investors were surprised to find out that Facebook’s user numbers have shrunk for the first time. The shock was so big that other social media companies took a beat, too, as Snap, Twitter, and Pinterest stocks fell too. Even the cryptocurrency market was affected as metaverse tokens dropped.

How did analysts react to the earnings miss?

Copy link to sectionAnalysts reacted immediately. For instance, J.P.Morgan downgraded the stock to hold with a price target of $284.

However, not everyone had a negative reaction to the earnings. Take Goldman Sachs, for example, which maintained its buy rating with a price target of $355 for Meta’s stock price.

All in all, Meta missed expectations, and the move in after-hours led to erasing all gains made last year. Rivals in the tech space continue to grow, as seen by Alphabet, that reported stellar Q4 earnings.

Meta’s stock price has peaked at $380 in 2021 and has been on a declining trend since last September. It bounced temporarily from horizontal support in the $300 area, but that support is long gone after yesterday’s poor earnings.

More industry news