Here’s why ZIM Integrated stock price could retreat soon – WSJ

- ZIM Integrated share price has jumped by over 31% this year.

- It is on track to have its best week on record.

- The Wall Street Journal estimates that these gains could be limited.

ZIM Integrated (NYSE: ZIM) stock price is on track for its best weeks on record. The shares are up by over 31% this week and are sitting at their highest point since August 23rd. They have risen by more than 112% from their lowest level in 2022.

ZIM integrated stock

ZIM is not alone as other shipping giants like Maersk, Evergreen, and Hapag-Lloyd stocks have surged hard this year. This performance is because of the ongoing crisis in the Middle East, which could continue for a while. In a statement this week, Maersk said that it will continue pausing its transit through the Red Sea.

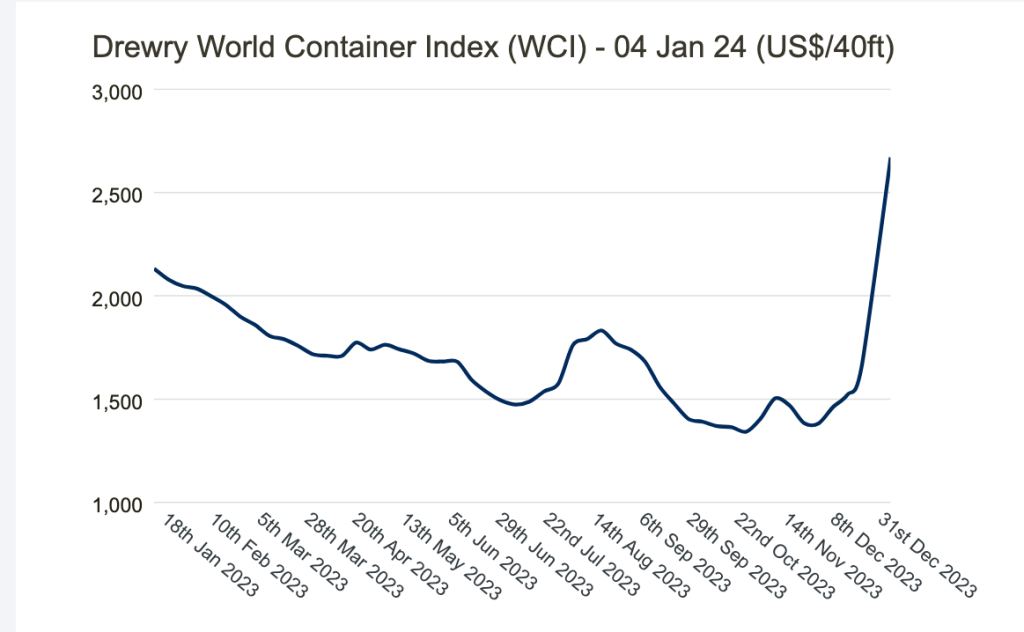

The implication of this crisis has been swift in the shipping industry. As shown below, the closely watched World Container Index has jumped to $2,670. This happened as shipping companies were forced to take a longer route around South Africa.

ZIM Integrated and other companies in the industry will benefit from all this. Besides, shipping costs have been in a freefall in the past few months after the pandemic boom ended.

However, the WSJ is cautioning that shipping stocks could pull back soon. In a report on Friday, the paper cited the fact that more shipping capacity is about to increase. The paper estimates that new container fleet equal to 11% of the existing fleet will come online this year.

It also estimates that these companies will still addd about 7% of the current capacity in 2025. Fleet utilization remains stubbornly low at about 70%. Therefore, a combination of more ships and low utilization means that the prices will likely remain under pressure for a while.

The other challenge is that the rising shipping costs could spur inflation and force central banks to be more cautious on rate cuts. As we have seen in the past two years, shipping companies tend to underperform in a period of high-interest rates. Just this week, Tom Barkin of the Richmond Fed warned that the Fed could still hike rates.

The other challenge is that the crisis is pushing oil prices higher. Brent, the global benchmark, has risen to $78.13 while West Texas Intermediate (WTI) rose to $73. This means that ZIM Integrated will likely see higher operational costs, which will hurt its margins.

More industry news