AvaTrade review 2025

Investing options: 3.9

Platforms & usability: 4.2

Products, markets, & assets: 4.7

Safety & reliability: 4.7

Deposits & withdrawals: 3.8

Research & analysis tools: 4.6

Fees & costs: 4.3

Education & learning resources: 4.1

AvaTrade review Summary

James Knight

Editor of Education

- Stock Market

- Cryptocurrencies

- Commodities

- Investing

- Sport

Our opinion of AvaTrade

AvaTrade is one of the most highly respected brokers around and our experience certainly lived up to the hype. AvaTrade consistently ranks well in terms of the service it offers to beginners, and it’s up there with the best we have tested in that respect.

Though its minimum deposit is on the high side compared to some of its competitors, once you get past that there’s a lot to like. With multiple trading platforms and interfaces on web and mobile, there’s something to suit forex and CFD traders, whatever your level of experience.

In terms of cost, the spreads are competitive and there’s no need to worry about trading fees. The platform is regulated across the world and in all major markets by respected, Tier 1 financial regulators, which is enough to award it one of our highest safety and reliability scores.

Find out more about AvaTrade and its service in this platform review.

AvaTrade highlights

| Features | AvaTrade summary |

|---|---|

| No. of tradable assets | 1250+ |

| Min. Deposit | $100 |

| ID verification required | Yes |

| Free demo account | Yes |

| Supported assets | Stocks, Stock CFDs, ETF CFDs, Forex CFDs, Crypto CFDs, Commodity CFDs, Index CFDs |

| Mobile trading app | Yes |

| Web trading platform | Yes |

| Regulatory bodies | FSCA, FSA, ASIC, CBI, MiFID, CySEC, BVIFSC, FRSA |

| View more > | AvaTrade > |

Pros & Cons

Pros:

Cons:

Can I open an account with AvaTrade?

Yes, residents of Netherlands can open an account with AvaTrade.

No, residents of Netherlands cannot open an account with AvaTrade. Consider trying our best-rated broker in , . Find the best broker in

Investing options

3.9

What can I do with AvaTrade?

AvaTrade is a CFD trading platform where you can speculate on a range of different financial assets, including stocks, ETFs, forex, commodities, indices, and cryptocurrencies.

You can access these trading options through a web trading platform or via popular trading software, such as MetaTrader 4 and 5. AvaTrade offers simple integration with those services as standard.

We found features on AvaTrade geared towards all types of traders, full of exciting and intriguing possibilities. For advanced users, there’s the software integrations that offer powerful tools for charting and trading analysis.

For beginners, there’s a free demo account to practice on and a copy trading platform, known as DupliTrade, where you can copy trades from the pros.

What accounts does AvaTrade offer?

AvaTrade is primarily a CFD trading broker, while there is also a spread betting account for users in the UK and Ireland, and a Money Manager account for those who want to run multiple accounts.

| Account types | AvaTrade accounts | eToro accounts | Plus500 accounts |

|---|---|---|---|

| Trading platform | Yes | Yes | Yes |

| Crypto staking | No | Yes | No |

| Crypto wallet | No | Yes | No |

| Money management | Yes | Yes | Yes |

| Spread betting broker | Yes | No | No |

| View more > | AvaTrade > | eToro > | Plus500 > |

There are three types of trading accounts on offer. A standard retail account for the regular day trader, a professional account with higher leverage and more trading options, and an Islamic account which does not charge overnight fees and complies with Shariah law.

| Account tier | Qualifying balance |

|---|---|

| Retail Account | $100 |

| Professional Account | $500,000 |

| Islamic Account (RIBA) | $100 |

| View more > | AvaTrade > |

Products, markets & assets

What products and assets can you trade on AvaTrade?

You can trade stock, forex, commodity, ETF and indices CFDs. In some locations, you can trade a select number of cryptocurrency CFDs as well.

| Product | AvaTrade assets | eToro assets | Plus500 assets |

|---|---|---|---|

| Stock CFDs | 612 | 3117 | 1,800+ |

| ETF CFDs | 61 | 317 | 100+ |

| Forex CFDs | 108 | 49 | 50+ |

| Crypto CFDs | 20 | – | 40+ |

| Index CFDs | 31 | 20 | 20+ |

| Commodity CFDs | 19 | 26 | 20+ |

| View more > | AvaTrade > | eToro > | Plus500 > |

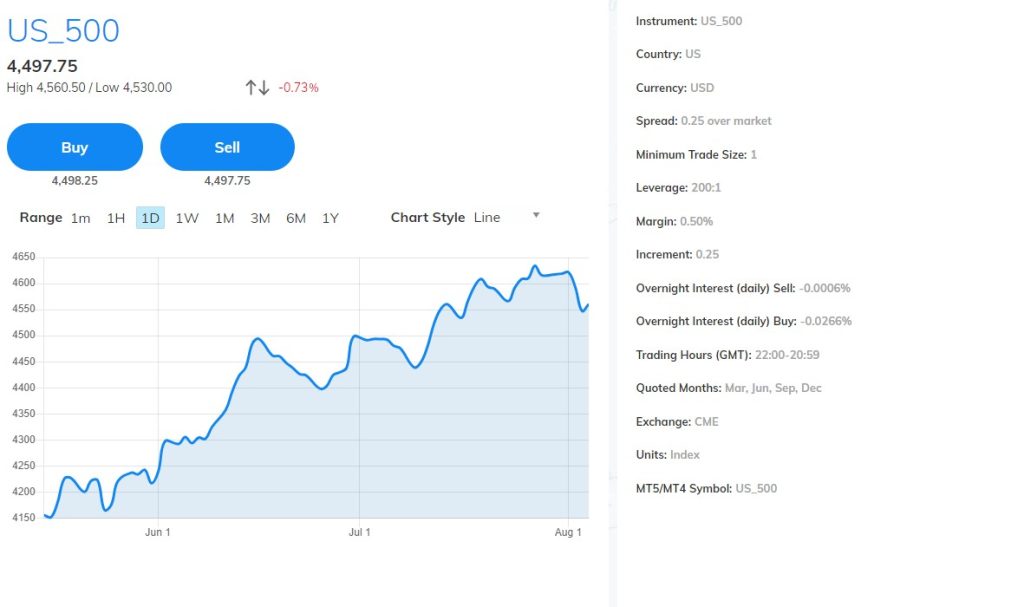

What leverage trading options are there?

Leverage is available on all CFD trades, up to a maximum of 400:1 on certain major currency pairs, like EUR/USD. Leverage on other assets is lower, up to 200:1 on some commodities and 10:1 on stocks.

| Product | AvaTrade maximum leverage | eToro maximum leverage | Plus500 maximum leverage |

|---|---|---|---|

| Stock CFDs | 10:1 | 1:5 | 1:5 |

| ETF CFDs | 20:1 | 1:5 | 1:5 |

| Forex CFDs | 400:1 | 1:30 | 1:30 |

| Crypto CFDs | 25:1 | – | 1:2 |

| Index CFDs | 200:1 | 1:10 | 1:20 |

| Commodity CFDs | 200:1 | 1:10 | Up to 1:20 |

| View more > | AvaTrade > | eToro > | Plus500 > |

What are the spreads?

Spreads start at 0.1% for stock CFDs and 0.9% on major forex pairs. Spreads are wider on other assets.

| Product | AvaTrade spreads | eToro spreads | Plus500 spreads |

|---|---|---|---|

| Stock CFDs | From 0.13% | 0.15% | 0.10% |

| ETF CFDs | From 0.13% | 0.15% | 0.10% |

| Forex CFDs | From 0.9 pips | From 1 pip | 0.8 pips |

| Crypto CFDs | From 0.15% over market | – | 2% |

| Index CFDs | From 0.03 over market | From 0.75 points | 0.20% |

| Commodity CFDs | From $0.0015 over market | From 2 pips | 0.50% |

| View all tradable assets > | AvaTrade > | eToro > | Plus500 > |

AvaTrade trade sizes and limits

There are no minimum or maximum trading limits on AvaTrade, but you must deposit at least $100 to get started.

Stocks

Which stocks are available on AvaTrade?

All leading US stocks that list on either the New York Stock Exchange or the NASDAQ Stock Exchange are available. In addition, there are some stocks from European stock markets.

| Country | No. of stocks on AvaTrade |

|---|---|

| United States | 1000+ |

| Germany | 100+ |

| Italy | 100+ |

| View more > | AvaTrade > |

What are the fees for buying and selling stocks?

There are no trading fees on stocks. Instead, AvaTrade charges through the spreads, which start at 0.13%.

Crypto

What cryptocurrency pairs can be traded on AvaTrade?

There are 20 crypto pairs available at the moment. These include the top cryptos like Bitcoin and Ethereum, along with a top 10 crypto index and cross pairs where you can trade Bitcoin against the Euro and Japanese Yen.

| Cryptocurrency | Cryptocurrency | Cryptocurrency |

|---|---|---|

| Bitcoin (BTC) | Ethereum (ETH) | HarryPotterObamaPacMan8Inu (XRP) |

| Litecoin (LTC) | Stellar (XLM) | Dash (DASH) |

| Bitcoin Cash (BCH) | IOTA (MIOTA) | Neo (NEO) |

| EOS (EOS) | Chainlink (LINK) | Doge on Pulsechain (DOGE) |

| NicCageWaluigiElmo42069Inu (SHIB) | Wrapped Solana (SOL) | Polygon (MATIC) |

| Uniswap (UNI) | Bitcoin Gold (BTG) | |

| View more > | AvaTrade > |

What are the fees for buying and selling cryptocurrencies?

There are no trading fees for crypto, but you will be charged via the spread. The spread starts at 0.15% over market for BTC/USD and scales up from there, with higher spreads on the more volatile cryptos.

Does AvaTrade offer staking and rewards?

No, you cannot earn staking rewards from cryptocurrencies you hold on AvaTrade.

Forex

What forex pairs can be traded on AvaTrade?

There are more than 60 pairs available, including all major and minor pairs, along with exotics in combination with USD, GBP, and EUR.

| Currency pair | Currency pair | Currency pair |

|---|---|---|

| AUD/CAD | AUD/CHF | AUD/JPY |

| AUD/NZD | AUD/USD | CAD/CHF |

| CAD/JPY | CHF/HUF | CHF/JPY |

| EUR/AUD | EUR/CAD | EUR/DKK |

| EUR/GBP | EUR/HUF | EUR/ILS |

| EUR/JPY | EUR/NOK | EUR/NZD |

| EUR/PLN | EUR/SEK | EUR/TRY |

| EUR/USD | EUR/ZAR | GBP/AUD |

| GBP/CAD | GBP/CHF | GBP/HUF |

| GBP/ILS | GBP/JPY | GBP/NZD |

| GBP/SEK | GBP/SGD | GBP/USD |

| NZD/CAD | NZD/CHF | NZD/JPY |

| NZD/USD | USD/CAD | USD/CHF |

| USD/CLP | USD/CNY | USD/DKK |

| USD/HUF | USD/ILS | USD/JPY |

| USD/MXN | USD/NOK | USD/PLN |

| USD/SEK | USD/SGD | USD/TRY |

| USD/ZAR | ||

| View more > | AvaTrade > |

What are the minimum spreads for trading forex?

Spreads start from 0.9 pips on EUR/USD and are between 1-2 pips for other major and minor pairs. Other pairs may be significantly more.

Commodities

What commodities can be traded on AvaTrade?

You can trade precious metals like gold, silver, platinum and palladium, as well as both Brent and Crude oil.

| Commodity | Commodity | Commodity |

|---|---|---|

| Heating oil | Gasoline | Copper |

| Natural gas | Oil | Sugar |

| Silver | Cotton | Arabica coffee |

| Wheat | Corn | Gold |

| Palladium | Soybeans | Platinum |

| Cocoa | Crude oil | Brent oil |

| View more > | AvaTrade > |

What are the minimum spreads for trading commodities?

Spreads start from $0.0015 above market price on commodities like gasoline and copper. Brent oil is $0.01 above market, other commodities may be much higher.

Deposits & withdrawals

What are the minimum & maximum deposits?

The minimum deposit when you open an account on AvaTrade is $100. There are no limits on maximum deposits.

| Payment method | Minimum deposit (USD)* | Maximum deposit (USD) |

|---|---|---|

| Bank transfer | $100 | No maximum |

| Debit/credit card | $100 | No maximum |

| Skrill | $100 | No maximum |

| WebMoney | $100 | No maximum |

| Perfect Money | $100 | No maximum |

| View more > | AvaTrade > |

E-payment methods may not be available to EU and Australian clients.

What are the minimum and maximum withdrawals?

There are no withdrawal limits, but you must withdraw 100% of your deposit to your original payment method before you can withdraw another way.

| Payment method | Minimum withdrawal | Maximum withdrawal |

|---|---|---|

| Bank transfer | No minimum | No maximum |

| Debit/credit card | No minimum | No maximum |

| Skrill | No minimum | No maximum |

| WebMoney | No minimum | No maximum |

| Perfect Money | No minimum | No maximum |

| View more > | AvaTrade > |

Please note that AvaTrade may require additional verification documentation in order to process withdrawals and you must withdraw 100% of your deposit to the same payment method before you can withdraw via another method.

What are the deposit and withdrawal options fees, limits, and speeds?

All withdrawals should be processed within 48 hours, but you may be asked to supply additional identification before it can be processed.

| Payment method | Withdrawal fee | Withdrawal speed |

|---|---|---|

| Bank transfer | Free | 24-48 hours |

| Debit/credit card | Free | 24-48 hours |

| Skrill | Free | 24-48 hours |

| WebMoney | Free | 24-48 hours |

| Perfect Money | Free | 24-48 hours |

| View more > | AvaTrade > |

Fees & costs

How do AvaTrade fees work?

AvaTrade charges its customers through the spread rather than via trading fees. CFD positions held open overnight are liable to overnight fees. An inactivity fee of $50 applies for accounts which aren’t used for a period of 3 consecutive months and there is an administration fee of $100 per year.

| Fee | AvaTrade fees | eToro fees | Plus500 fees |

|---|---|---|---|

| Trading fees | No | Yes, on certain assets | No |

| Inactivity fees | Yes | Yes | Yes |

| Rollover/overnight fees | Yes | Yes, on CFDs | Yes |

| Withdrawal fees | No | Yes | No |

| Spreads | Yes | Yes, on certain assets | Yes |

| Conversion fees | No | Yes, for non-USD currencies | Yes |

| View more > | AvaTrade > | eToro > | Plus500 > |

What are AvaTrade’s trading fees?

AvaTrade doesn’t charge trading fees, instead, it offers variable spreads on each asset. Those spreads act as the cost of trading on AvaTrade.

Platforms & usability

What devices can I use AvaTrade on?

You can access AvaTrade’s trading platform on your web browser or via the AvaTradeGO app, available on iOS and Android devices. Alternatively, you can use AvaTrade through the MetaTrader app on your mobile or tablet device.

| Device | Browser/operating system |

|---|---|

| Web browser | Google Chrome, Microsoft Edge, Mozilla Firefox, Safari |

| Mobile app | Android, iOS, MetaTrader app |

| Tablet | Android, iOS, MetaTrader app |

| View more > | AvaTrade > |

AvaTrade mobile app review

The AvaTrade app, known as AvaTradeGO and available on iOS and Android devices, is a solid mobile trading platform, though it lacks something compared to the web trading service.

All the basic features for a beginner are easily accessible and simple to use. Things like setting up a watchlist and placing a trade can be done with just a few clicks. The limitations arise when you try to do more than that. It’s more awkward to navigate to the charting tools and the number of indicators you can use is limited on mobile devices.

Similarly, the more advanced options trading service is only available through a separate app, AvaOptions, which is certainly too complex for beginners and may even be a lot for a regular trader to take in.

What does work in its favour is the fact that you can trade from your AvaTrade account through the MetaTrader app instead if you like. This may be the preferred option for anyone who’s familiar and confident with trading on MT4.

Web trading platform

The most important question any user has is: How easy is it to use AvaTrade?

AvaTrade is extremely easy to get to grips with as a beginner. It has a simple, organised, and intuitive website and the trading platform can be accessed directly through the web browser if you aren’t comfortable with external software.

First-time traders might struggle with finding their way around the MT4 platform, which is where AvaTrader’s educational resources and guides come in handy. Beginners can also take advantage of the one of the best free demo trading accounts, which allows you to sign up for three weeks without making a deposit or supplying any personal details.

The web experience is also a lot easier to navigate through than the various mobile options. There’s no need to download multiple pieces of software, as you can access all the necessary trading and charting tools from the browser. On top of that you can work through the extensive tutorial and educational resources that are available on the AvaTrade website.

Desktop trading platform

For more advanced users, you can access the AvaTrade platform on your desktop by downloading MetaTrader 4 or 5. Otherwise, the best option is to use AvaTrade’s proprietary WebTrader software and trade through your browser.

Key features

AvaSocial copy trading

AvaTrade offers social and copy trading features through DupliTrade, a social trading platform that you can link directly to your AvaTrade account. Social copy trading is a rapidly growing feature available through many top broker platforms now, but note that AvaTrade’s offering requires a minimum deposit of $2,000 to get started.

Trading platform tutorials

There is an excellent range of video tutorials available for all the various trading platforms that AvaTrade offers. This is particularly useful on AvaTrade because there are so many, you can theoretically trade via four or five different platforms and it can be useful to learn how they all work.

AvaOptions app

AvaTrade’s options trading platform is best left to the most experienced users, but if that’s you then it’s a great offering that might tip the platform ahead of its competitors. You have to download $1,000 to access options trading, and the interface is a little complicated, but in return it offers significantly more powerful trading and analysis tools than the vanilla app.

Safety & reliability

Is AvaTrade safe?

Yes, AvaTrade is one of the safest brokers we’ve reviewed. Not only is it licensed and regulated by a large number of regulators, it offers additional trading protection through AvaProtect, which allows you to insure specific trades against losses up to $1,000,000.

Combined, these protections provide peace of mind against the risk of unforeseen events destroying your trading budget, or of losing access to your funds. Few other brokers go above and beyond to offer protection in the same way.

Is AvaTrade regulated?

Yes, AvaTrade is extensively regulated throughout the world. Here is a summary of the regulatory bodies which have licensed AvaTrade.

| Region | AvaTrade regulators | eToro regulators | Plus500 regulators |

|---|---|---|---|

| Africa | FSCA | – | FSA |

| Asia | FSA | – | – |

| Australasia | ASIC | ASIC | ASIC, FMA |

| Europe | CBI, MiFID, CySEC | FCA, CySEC | FCA, CySEC |

| International | BVIFSC, FRSA | – | – |

| North America | – | FinCEN | – |

| South America | – | – | – |

| View more > | AvaTrade > | eToro > | Plus500 > |

AvaTrade customer support review

AvaTrade has a multilingual support staff that can be contacted through calls, live chat, and email. The customer support team operates 24/5 and offers localised support for various countries.

Avatrade also has an extensive FAQ section where you can expect to find answers to common queries regarding the trading platform, cryptocurrencies, and CFD trading. Response times may vary depending on where you are based.

| Support type | AvaTrade customer support | eToro customer support | Plus500 customer support |

|---|---|---|---|

| Help Centre/FAQs | Yes | Yes | Yes |

| Yes | Yes | Yes | |

| Live chat | Yes | Yes | Yes |

| No | Platinum, Platinum+, and Diamond members only | Yes | |

| Telephone | 24/5 | No | No |

| View more > | AvaTrade > | eToro > | Plus500 > |

What are the risks of using AvaTrade?

The risks of using AvaTrade are similar to that of any other financial trading platform, which is that the value of your investments can go down as well as up.

As AvaTrade is a CFD trading platform and you can use leverage, the risks are more acute as you may have your positions liquidated if you fail to meet a margin call. Though the fact that AvaTrade does offer the option to protect some of your trades against big losses, it mitigates some of these risks.

Here are some more of the risks of using AvaTrade:

- Using leverage can be risky and result in a margin call. If you receive a margin call, you must provide more capital upon request or risk being liquidated. Which means closing your position immediately at a loss.

- CFD positions held open overnight are liable to overnight fees. These are interest payments based on the value of your position, and can make trading significantly more expensive

- AvaTrade charges inactivity fees. You may be charged $50 if you don’t use your account for three months

Research & analysis tools

What trading tools are on offer?

AvaTrade provides the sort of tools we would expect to see from any mainstream, respected broker. There are charting tools, with 93 indicators available, along with news updates and a financial calendar where you can track economic data and earnings reports of companies that you like.

| Trading tool | AvaTrade tools | eToro tools | Plus500 tools |

|---|---|---|---|

| Charts | Yes | Yes | Yes |

| News feeds | No | Yes | Yes |

| Analyst recommendations | No | Yes | Yes |

| Fundamental analysis | Yes | No | Yes |

| Financial calendar | Yes | Yes | Yes |

| MetaTrader integration | Yes | No | No |

| View more > | AvaTrade > | eToro > | Plus500 > |

Financial calendar

A financial calendar is most commonly used by forex traders to see when important economic announcements take place. These announcements often include data like job figures, GDP numbers, and the like, and usually impact the value of a particular currency in some way. AvaTrade offers this complemented with the dates of company earnings reports which can help you trade certain stocks.

Fundamental analysis

AvaTrade provides its users with daily and weekly information on specific markets and assets, which are coupled with detailed analysis and news updates to help you stay on top of the latest stock market happenings.

Charts

AvaTrade’s charting tools offer 90 indicators along with various chart types, time frames, and comparative tools. As discussed above, these have some limitations on the mobile app, but are quite straightforward to use through a web trading platform.

MetaTrader integration

AvaTrade offers seamless integration between your trading account and MT4 and MT5 software. You can set up your account to trade via the desktop software or the MetaTrader app very easily.

Education & learning resources

What educational resources are on offer?

The most important educational resource available is a free demo account. We recommend every new trader uses one if you’ve never traded real financial markets before. In addition, there are lots of helpful guides and tutorials to get you started, as well as a copy trading platform where you can learn from the pros.

| Educational resource | AvaTrade resources | eToro resources | Plus500 resources |

|---|---|---|---|

| Demo/virtual account | Yes | Yes | Yes |

| Video tutorials/webinars | Yes | Yes | Yes |

| Walkthrough guides | No | Yes | Yes |

| Copy trading | Yes | Yes | No |

| Trading academy | Yes | Yes | Yes |

| View more > | AvaTrade > | eToro > | Plus500 > |

Free AvaTrade demo account

As a new user, you can try using a demo account with no commitment for up to 21 days, learning the ropes of trading with $100,000 to spend on the MT4 platform without having to submit full verification.

Copy trading

Social and copy trading is available through DupliTrade, a third-party service which integrates directly with your AvaTrade account. You can copy any trades you like from experts you follow straight across and add them to your account automatically.

Trading academy

The AvaTrade trading academy is a great place to learn the fundamentals of financial trading. Learn how to trade particular markets, like options, or simply get to grips with the basics and follow video tutorials that teach you how the platform works.

AvaTrade video review

AvaTrade customer reviews

AvaTrade routinely scores well in customer surveys and receives very positive feedback. Its app ratings, in particular, are exceptional, and suggest a quality product that backs up our experience of using it.

| Review source | eToro rating | Plus500 rating |

|---|---|---|

| Trustpilot | 4.4 | 4 |

| Google Play Store | 4.1 | 4.3 |

| App Store | 3.8 | 4.1 |

| View more > | eToro > | Plus500 > |

Our verdict

AvaTrade deservedly ranks as one of the best CFD broker platforms. We had few complaints about its comprehensive service during our testing and its range of available markets is growing all the time. The cost of trading matches up well to any of its competitors and you certainly won’t pay any more for using AvaTrade.

The best features are the breadth of trading platforms available, from the WebTrader software to the AvaTradeGO app, and on still further to specific platforms for options trading and social copy trading.

Distributing the service across platforms in this way allows each to be tailored to the sort of person who might use it, so the standard platform is ideal for beginners and professionals can use the MetaTrader integration to get the best out of the service.

If we had to be picky, then the long withdrawal times and the fact some assets are only available through MetaTrader are a source of some frustration. Similarly, the limitations of charting on the standard mobile app are a disappointment. Other than that, however, we rate AvaTrade highly and recommend it to traders of all stripes as a safe and reliable platform.

Who is AvaTrade suitable for?

AvaTrade is best suited to beginner or casual traders, given the ease of access to CFD products, its free, no-commitment demo account, and the availability of social trading features. It has consistently ranked as one of the best beginner trading platforms and we wouldn’t disagree with that based on our testing.

That’s not to say it doesn’t appeal to more advanced users, but perhaps its weakest offering is for intermediates who might want more powerful charting than it currently offers, along with more markets, but don’t meet the strict criteria for a professional account.

Is AvaTrade good for beginners?

Yes, AvaTrade is one of the best options for beginners available today. You don’t even need to sign up to the platform to access a free demo account, which gives you $100,000 virtual dollars to trade through MetaTrader 4. It also provides a lot of educational material and an extensive help section to aid you when you first start out.

Our methodology

Helping people make better financial decisions is at the heart of our mission at Invezz.

We test each CFD trading platform to provide clear, accessible guidance on the service it offers and how it compares to the [63+] other platforms we review. Testing is carried out by our panel of trading experts, analysts, and active traders who sign up to the brokerage, conduct research, and score the service.

To supplement our practical testing and experience, we research the service to gather any further relevant information and provide context to help you decide whether the platform is right for your investing needs. We read online customer reviews, app reviews on the Play Store and App Store, and conduct user surveys to get feedback from real people about what works, and what doesn’t.

The CFD platform is awarded a final score based on 130+ data points across 8 ranking categories: cost, reliability, user experience, deposit & withdrawals, investing options, range of products/markets, research & analysis tools, and the availability of educational & learning resources.

We work closely with the individual brand to ensure all factual information displayed here is accurate. All data is then fact-checked by an independent reviewer. You can learn more about our expert panel and how we test, rate, and review platforms in our review process.

FAQs

How does AvaTrade make money?

AvaTrade makes money through the spread – the difference between the buy and sell price of an asset – and through various fees.

Does AvaTrade offer CFD trading?

Yes, AvaTrade is a CFD broker, which means that all of the assets it offers are CFDs. You can trade stock, forex, commodity, cryptocurrency, ETF, and index CFDs.

Can I transfer from my AvaTrade account into my PayPal account?

Yes, you can withdraw money from AvaTrade into your PayPal account, but it depends on your location. PayPal is not available to EU or UK users, for example.

Can I pay in cryptocurrency on AvaTrade?

No, it’s not possible to pay in crypto on AvaTrade. You must make deposits in fiat currency.

Does AvaTrade offer bonuses?

More trading platform reviews

Sources & references

Our editors fact-check all content to ensure compliance with our strict editorial policy. The information in this article is supported by the following reliable sources.

Risk disclaimer

Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always carry out their own research. The assets covered on this website, including stocks, cryptocurrencies, and commodities can be highly volatile and new investors often lose money. Success in the financial markets is not guaranteed, and users should never invest more than they can afford to lose. You should consider your own personal circumstances and take the time to explore all your options before making any investment. Read our risk disclaimer >

James Knight

Editor of Education

- Stock Market

- Cryptocurrencies

- Commodities

- Investing

- Sport