Faraday Future stock is beating Tesla: is it a good buy?

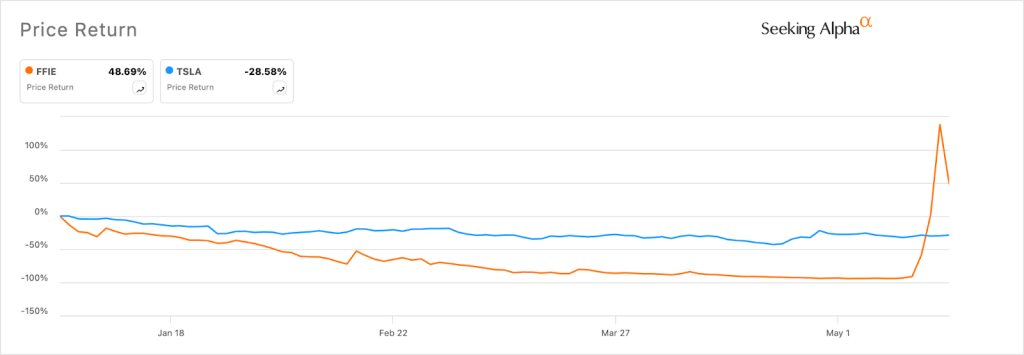

- Faraday Future’s stock has jumped by over 50% this year.

- Tesla has dropped by almost 30% this year alone.

- Faraday Future is facing substantial challenges as its cash burn continues.

Faraday Future Intelligent Electric (NASDAQ: FFIE) stock price is beating Tesla this year as the meme frenzy gains steam. It surged by over 95% in the pre-market session having jumped by over 8,000% from its lowest level this year. Its market cap has soared to over $43 million.

Notably, Faraday Future stock has risen by over 50% this year, beating Tesla, which has dropped by almost 30%. It has also beaten other popular electric vehicle (EV) companies like Rivian, Mullen Automotive, and Lucid Motors.

Faraday Future is still in trouble

Copy link to sectionFaraday Future’s shares have jumped because of the ongoing meme stock frenzy that started last week. At the time, most meme companies like GameStop, AMC, and Blackberry jumped sharply as the short squeeze gained steam.

Faraday’s performance has happened in a high-volume environment. Its volume jumped to over $125 million on Friday, up from $113.7 million on Thursday. The average volume in the past five days stood at $441.3 million, higher than the previous $97.2 million.

The current meme stock frenzy will not save Faraday Future, a company that is incinerating substantial sums of money. It has already burnt over $3 billion over the years and its balance sheet has limited cash left in its balance sheet.

Its most recent financial report showed that it had less than $9 million in cash. Most of its current assets was customer deposits of $62.5 million. At the same time, Faraday Future had a net loss of over $78 million in the third quarter, down from $113 million in the same quarter in 2022.

Faraday will continue making losses for a while, meaning that it will need to raise additional capital at some point. Other EV companies like Rivian, Lucid, and VinFast are still losing millions of dollars each quarter years after they started shipping vehicles.

The challenge for Faraday is that its equity valuation is still tiny since it has a market cap of less than $50 million even after the stock surged.

Meme stocks always plunge

Copy link to sectionFurther, history shows that meme stocks don’t rise forever. GameStop jumped to $120.70 in 2021 and then crashed to $10. Last week, it jumped to over $60 and then tumbled to about $20. Similarly, AMC jumped to almost $400 in 2021 and then became a penny stock recently.

Therefore, I believe that many traders will be left holding the bag since Faraday Future’s future is still in peril. Besides, data shows that the electric vehicle industry is not doing well Li Auto, one of the strongest companies in China, published weak financial results as the weakness gained steam.

Tesla (NASDAQ: TSLA), on the other hand, is going through a turmoil as its sales tumble. However, it is still the most popular EV brand globally and is making billions of dollars in revenues and profits. Its revenue dropped to $21.3 billion in the last quarter while its net profit came in at $1.1 billion.

More industry news