Mantra (OM) crashes, co-founder blames forced exchange liquidations

- Mantra (OM) token crashes over 90%, erasing $6 billion.

- Co-founder blames the crash on cryptocurrency exchange liquidations.

- Community divided on insider dumping claims.

The Mantra (OM) token has suffered a staggering collapse, plunging over 90% in value within a mere 24-hour span.

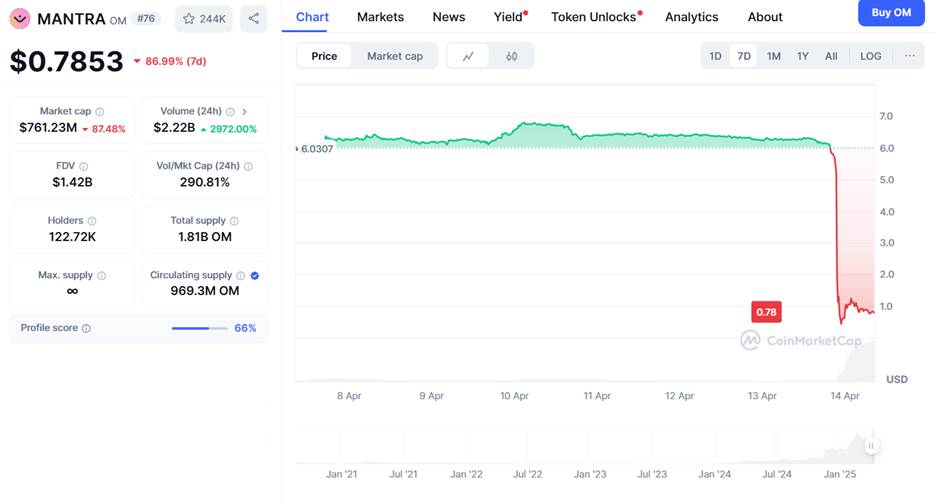

Trading at approximately $6 before the drop, the token bottomed out at $0.37 on April 13, 2025, before clawing back slightly to hover around $0.80 according to CoinMarketCap data.

This brutal decline erased nearly $6 billion from its market capitalization, catching investors off guard and sparking widespread alarm in the crypto space.

Mantra co-founder blames forced liquidations for the crash

Copy link to sectionMantra Co-Founder John Patrick Mullin was quick to dismiss swirling rumors of foul play, rejecting claims of insider trading or a deliberate rug pull by the Mantra team.

The co-founder stressed that all tokens held by the team and its investors remain locked under strict vesting schedules, untouched by the crash.

In a scathing X post, Mullin pinned the blame squarely on forced liquidations executed by centralized exchanges, though he excluded Binance from the list.

The co-founder argued that the exchanges triggered these sales during low-liquidity hours, a move that likely deepened the price spiral and devastated holders.

In the post, Patrick said, “We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice.”

He went ahead to also question how the liquidations happened on Sunday during low-liquidity hours, saying, “That this happened during low-liquidity hours on a Sunday evening UTC (early morning Asia time) points to a degree of negligence at best, or possibly intentional market positioning taken by centralized exchanges.”

According to the co-founder, the forced closures hit OM account holders without warning, catching the market at its most vulnerable.

The Mantra team has launched an investigation into the incident, promising to share findings with its rattled community.

Mullin also announced plans for an open discussion to address concerns and chart a path forward, signaling a bid to restore faith.

OM token crash damages Mantra’s reputation

Copy link to sectionMantra has carved a notable niche in the blockchain world, focusing on tokenizing real-world assets (RWA) with high-profile partnerships like Google Cloud and DAMAC Group bolstering its reputation.

Its recent $1 billion deal with DAMAC and a Virtual Asset Service Provider license from Dubai’s regulatory authority had fueled optimism, making this abrupt downturn all the more jarring.

The crash has cast a shadow over what was seen as a promising player in the RWA sector.

The fallout from this crash has rippled beyond Mantra, spotlighting broader issues with centralized exchange practices and the fragility of RWA tokens.

Industry figures, including Kronos Research CEO Hank Huang, have called for stronger safeguards and transparency to prevent such debacles.

In addition, the parallels to past crypto disasters like Terra LUNA and FTX have only heightened the unease.

For now, Mantra’s future hangs in the balance as it grapples with shattered trust and a battered valuation.

The team’s ability to uncover the crash’s root causes and convince investors of its resilience will be critical.

This episode stands as a sobering reminder of the wild risks lurking in the digital asset frontier.