Baring PE acquiring Virtusa Corp (NASDAQ: VRTU)

- Baring PE will be acquiring Virtuas’ outstanding common stocks for $51.35 per share in an all-cash transaction

- The $51.35 per share implies the 16.2x Firm Value / Trailing Twelve Months EBITDA as of June 30, 2020.

- The transaction is expected to close in the first half of 2021.

On September 10, Virtusa Corporation (NASDAQ: VRTU) announced that it had signed a definitive merger agreement with Baring Private Equity Asia (BPEA). The Baring PE will be acquiring all Virtuas’ outstanding common stock for $51.35 per share in an all-cash transaction, translating into approximately $2.0 billion deal valuation.

The $51.35 per share implies the 16.2x Firm Value / Trailing Twelve Months EBITDA as of June 30, 2020. The acquisition amount represents around 29% and 46% premium over 30 Days and 60 Days volume-weighted average prices of Virtusa Corporation (NASDAQ: VRTU) stock, respectively. On July 20, the Virtusa Board of directors received an unsolicited acquisition proposal from an interested party.

Rowland T. Moriarty, Lead Independent Director of Virtusa’s Board of Directors, said, “Through this transaction, we are pleased to maximize value and deliver a significant, immediate cash premium to Virtusa’s shareholders. Today’s announcement is the culmination of a process by Virtusa and our financial advisors, which included engagement with strategic and financial parties regarding a potential transaction, and, after a thorough review, the Board unanimously concluded that this all-cash premium transaction with BPEA achieved the Board’s objective.”

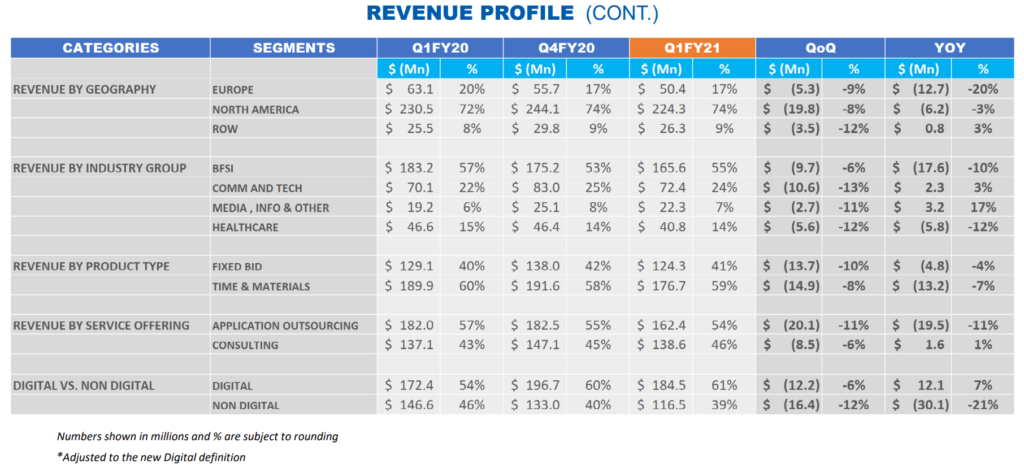

Headquartered in Massachusetts, Virtusa is a global provider of digital engineering and information technology outsourcing services. Virtusa provides technology consulting and implementation, business process management (BPM), mobility, business consulting, cloud, and application outsourcing services. The company has offices throughout the Americas, Europe, Middle East and Asia with global delivery centres in the United States, India, Sri Lanka, Hungary, Singapore, Poland, Mexico and Malaysia.

Baring Private Equity Asia is one of the largest independent PE firms in Asia with an asset under management of about $20 billion. Ever since the inception of BPEA in 1997, the private equity firm has made six prior investments in the information technology services industry.

The Orogen Group holds 108,000 shares of Virtusa Convertible Preferred Stock. The Orogens’ holding of 108,000 shares of Convertible Preferred Stock is convertible into 3,000,000 shares of Virtusa Common Stock. It represents approximately 10% of the voting power in the company. The Orogen Group CEO Vikram Pandit, who is an independent member of the Board, has entered into the voting agreement where he will be voting in favour of the transaction. Similarly, the directors and executive officers, collectively holding approximately 5.7% of the voting power in the company, will be voting in favour of the transaction.

The transaction is expected to close in the first half of 2021.

The transaction completion is subject to the approval of the Virtusa shareholders’ approval, necessary regulatory requirements, including approval from The Committee on Foreign Investment in the U.S. (CFIUS), and customary closing conditions.

More industry news