Housing unaffordability hits all-time high in UK

- The ratio of average house price to income is above 9 in the UK, the highest in 100 years

- Inflation persists in the double digits, kicking rent payments higher

- Younger generations cannot get on the property ladder, writes our Head of Research, Dan Ashmore

The excellent Irish economist, David McWilliams, said something in a recent podcast episode that got me thinking. “For the first time in many generations, today’s young people expect to be poorer than their parents”.

In a world where technology is improving at the speed of light, and where productivity has gone vertical, this is a staggering statement. And yet, looking at what has happened to asset prices over the past few decades, it is not surprising to hear this expectation.

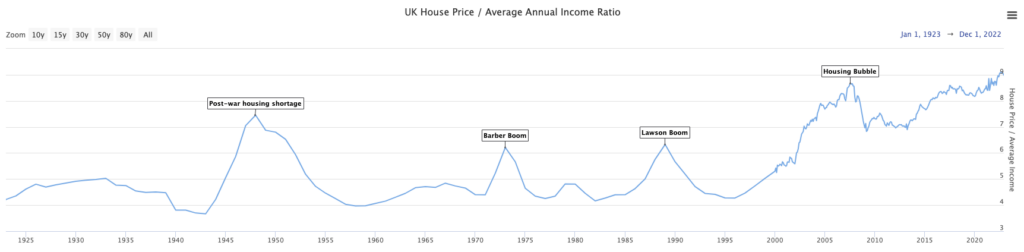

There is no better medium through which to express this generational conflict than the housing market. I came across the below chart via longtermtrends.net last week, which assesses housing affordability in the UK. Comparing the average UK house price to average annual income, the ratio is now above 9, higher than it was prior to the Great Financial Crash in 2008.

This is not a piece to say a housing crash is coming, mind you (I did a report on that in April. In short, while there has been softness in the market recently and price dips could well continue, it is hard to conclude from the underlying data that there will be a full-blown crash. Supply and demand is way out of whack, helping to provide a base, while variable rate mortgages have decreased and other factors have also changed since 2008, meaning the GFC is also not a fair comparison).

UK inflation among the highest in Western Europe

Copy link to sectionBut what the data does show is how difficult it is to be a young person in today’s economy. The UK is currently experiencing inflation among the highest in Europe, stubbornly persisting in the double digits. While this is expected to come down before the end of the year, the Bank of England recently said it does not expect to return to the 2% target before 2025.

This is making it harder and harder to get one’s foot on the property ladder because increased expenditure on everyday items, including rent payments, erodes away at one’s disposable income. The ability to save is reduced, meaning buying a house in the future becomes even more difficult again.

This is the way the world has been going for a while, especially in big cities, as housing supply simply has not kept up with demand. The below chart is a very crude way of showing this in the US, plotting the growth in population against the supply of new housing, but it is indicative.

Younger generations are getting squeezed

Copy link to sectionGetting back to the headline chart in this piece, the best way of plotting housing affordability is to simply plot the average house price against the average income. We showed above that this ratio is now higher than 2008. Zooming out on the chart to cover the last one hundred years shows how high it is historically, however. The ratio is over 9 today – it peaked post WWII at 7.45 amid the post-war housing shortage, while it was before 4 below the war.

Aside from brief spikes in the early 70s and late 80s, it was between 4 and 5 right up until the new millennium, which is when things started getting awry. It hit 8.6 before the crash in 2008, subsequently falling to 6.9, before gradually and incessantly rising since 2013, now above 9.

This last decade, of course, also coincides with basement level interest rates and an unprecedented amount of quantitative easing (until last year, at least). While we have been talking about the UK in this piece, plotting the Fed balance sheet in the US is the classic, if not clichéd, way of showing this.

This has sent asset prices to dizzying levels. Meaning, if you haven’t had assets, you have not benefited from these asset price rises, while you have suffered from the price rises in everyday items like food, energy and rent.

But housing is a massive part of this. Without an achievable route to a home, it is so difficult for young people to save and build wealth. For the older generation, “your house is your pension” is an oft-repeated line. Looking at how prices have risen over the last few decades reinforces this.

And yet today, unless one gets help from their parents, it is very challenging to purchase a home in their 20s. Not only that, but it is also extremely difficult to carry out the task in one’s 30s. Compared to previous generations, that has not been the case.

As the ratio of average house price to income breaks past 9, the highest in the last 100 years, times are difficult for young people.

More industry news