Here’s why Plus500, CMC Markets, IG Group shares are soaring

- Online forex and CFD brokers are firing on all cylinders this year.

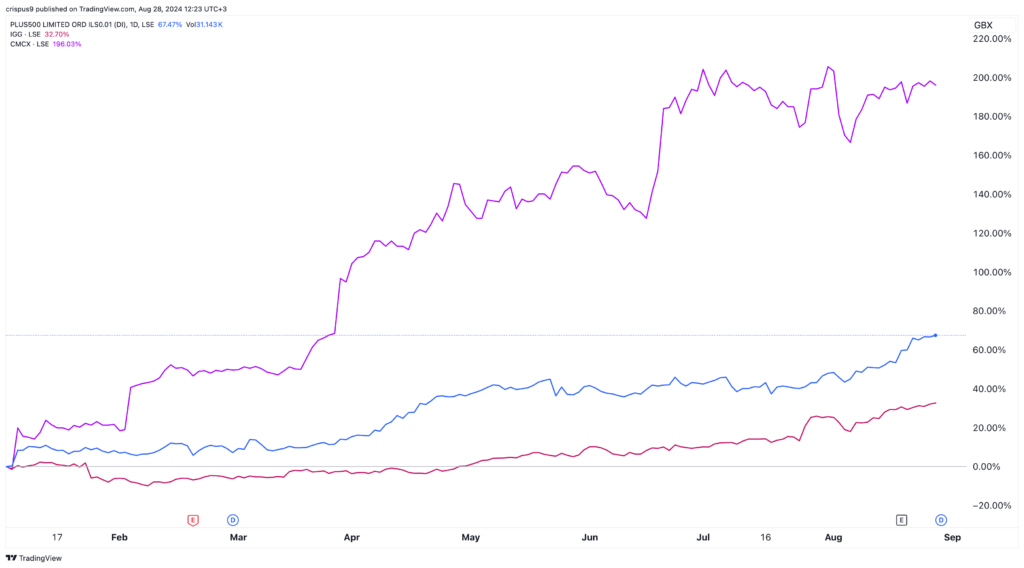

- CMC Markets stock has risen by almost 200% this year.

- IG Group and Plus500 have also surged as business conditions rebound.

UK-listed forex and contracts for difference (CFD) companies are doing well this year as monthly volumes bounce back and their cost-cutting measures work. Plus500 (PLUS) share price has risen in the last six consecutive months and in 9 of the last 10 months. It has jumped by over 68% this year and reached its all-time high.

IG Group (IGG) share price has also soared in the last six months and is up by over 31% this year and by almost 70% from its lowest point in 2023.

Similarly, CMC Markets (CMCX) stock has soared by over 293% from its 2023 lows. It has soared by more than 200% this year and is 30% below its all-time high of 472.5p, which it reached in 2021. These three companies have a market cap of £2 billion, £3.63 billion, and £925 million.

Hargreaves Lansdown acquisition

Copy link to sectionOne of the main reasons why these stocks have surged is the recent Hargreaves Lansdown buyout by a consortium of private equity companies led by CVC Capital Partners.

That buyout led to a sharp increase in related companies as it raised the probability that they could become takeover targets as well.

In addition to these brokers, stocks like St. James Place and Abrdn have also jumped in the past few months as hopes of more buyouts rise.

The stocks have also risen in line with the performance of other brokers. In the United States, Robinhood Markets has also risen by over 80% this year.

Strong financial results

Copy link to sectionThese stocks have done well as the global financial market remains vibrant. In the UK, the FTSE 100 index has jumped to a record high. Similarly, in Europe, most indices like the CAC 40 and the DAX index have jumped to all-time highs.

A similar action has happened in the United States, where the Nasdaq 100, S&P 500, and Dow Jones have soared. The forex market is also seeing strong market activity as the US dollar slump against most currencies.

In most cases, brokerage companies do well when there is strong market action of key financial assets since it leads to more demand.

The most recent financial results showed that their performance is starting to recover. IG Group’s annual revenue came in at £987 million, down from FY23’s £1.02 billion. In the same period, its profit before tax dropped to £400 million while the number of active customers fell to 346k.

Still, despite this, the management believes that it has positioned the company to do well in the future. For example, in October, the company decided to terminate 10% of its total workforce to conserve cash. IG Group announced a £150 million share buyback and an increase in its dividend to 46.2p.

Meanwhile, Plus500 continued to fire on all cylinders this year. Its revenue for the first half of the year rose by about 8% to over £398 million while its EBITDA came in at £183 million, a 6% increase from the same point last year.

Like IG Group, Plus500 has continued to return cash to shareholders. It announced £185 million in returns, with share buybacks of $110 million and dividends of $75.5 million. This is on top of the $175 million it announced earlier this year.

These are big numbers for a company valued at about $2 billion. Over the years, it has returned $2.3 billion to shareholders since going public.

CMC Markets has also continued doing well this year. The most recent results showed that it had over 266,870 customers.

Its trading income stood at over £259.1 million in the last financial year followed by investing net revenue of £34 million. Also, it has benefited from interest rates as its interest income came in at £35 million. Altogether, the net operating income rose to £332 million in FY24 from £288 million a year earlier.

Outlook for IG Group, Plus500, and CMC Markets

Copy link to sectionWe believe that IG Group, Plus500, and CMC Markets will continue doing well this year, especially now that interest rates are expected to retreat in key countries.

Ideally, low interest rates lead to better performance in the stock and crypto market as more people move from fixed asset investments.

Additionally, the three stocks have the momentum since analysts believe that they are undervalued.

However, the risk is that they are all getting highly overbought, meaning that investors may start taking profits. CMC Markets’s Relative Strength Index (RSI) has formed a bearish divergence and is at the overbought point of 70. Therefore, the stock needs to move above the key resistance point at 345p to continue the rally.

IG Group’s RSI on the weekly has moved to the extremely overbought point at 80 while Plus500 is at 85. Therefore, there is a risk that they will have a brief pullback in the near term.

More industry news