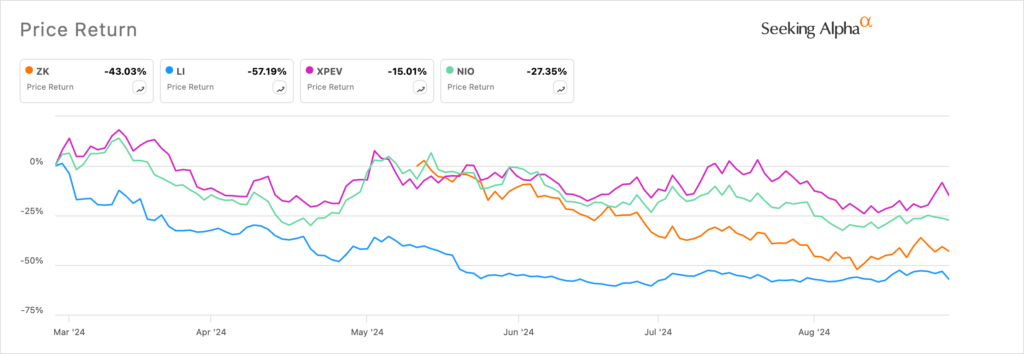

Very bad news for Li Auto, Xpeng, Zeekr, and Nio stocks

- Chinese EV companies are going through major headwinds.

- Li Auto's stock plunged by over 15% after missing analysts estimates.

- Other companies like Xpeng, Zeekr, and Nio have all crashed.

Chinese electric vehicle stocks are under pressure after the recent earnings showed the extent of the ongoing slowdown. Li Auto (LI) stock plunged by more than 17% on Wednesday, bringing the 12-month collapse to 55%. It has retreated by over 62% from the year-to-date high.

XPeng (XPEV) stock also crashed by over 10%, meaning that it has fallen by 60% in the last 12 months. Nio shares plunged by over 6.75% while Zeekr Intelligent Technology crashed by over 8.60%.

Weak earnings by Chinese EV companies

Copy link to sectionThe main reason for the sell-off is the fear that the Chinese EV bubble is bursting as evidenced by the recent earnings, which missed analysts estimates.

Li Auto, one of the most popular companies in the country, said that it delivered 108,581 vehicles in Q2, an increase of 25.5% from the same period in 2023. These delivery numbers were in line with expectation.

Its vehicle sales came in at RMB 31.7 billion or $4.2 billion, a 10% increase from the same quarter in 2023. While a 10% annual growth rate is a good one, it is much smaller than what Li Auto was used to before. Its net income was $154 million.

These results showed that Li Auto’s L6 brand has become highly popular, selling over 20,000 in two months since launch. Its more expensive multi-purpose vehicle, however, has not been successful.

Xpeng is not the only Chinese EV company that has reported mixed financial results. Xpeng, another leading EV company, said that its deliveries rose to 30,207 in Q2 from 23,205 in the same period in 2023. Its revenue was $1.12 billion, a 60.2% increase from last year.

While the company’s results were good they were lower than expected. Xpeng hopes that its new vehicle, Mona, which started selling on Wednesday, will help to supercharge its growth later this year. Compared to Li Auto, Xpeng seems to be doing better.

Zeekr, which went public recently, released strong financial results. It delivered 54,811 vehicles, a big increase from 27,399 while its vehicle sales soared to over $2.7 billion. It also increased its vehicle gross margins to 14.2% from 13.6%. Nio, another popular EV brand, is also expected to publish weaker results on September 9.

EV challenges remain

Copy link to sectionLi Auto’s results show that the industry is facing major challenges as the economy slows and supply increases.

As mentioned above, we see that these companies are all reporting double-digit delivery growth. And in addition to these, other big players like Tesla and BYD are selling hundreds of thousands of vehicles in China each quarter.

At the same time, companies dealing with Internal Combustion Engine (ICE) vehicles like Mercedes, Toyota, and Volkswagen are selling millions of vehicles each year at a time when the economy is slowing.

Therefore, Chinese EV companies are looking for growth in other countries in Southeast Asia, Middle East, Europe, and Mexico. On the positive side, Europe has removed its heavy tariffs on Chinese EVs.

Nonetheless, I believe that these companies will need more time to compete in European countries since many people in the region love their local brands like Renault and BMW.

The other challenge is that EVs are depreciating at a faster pace than ICE vehicles because of their batteries.

Therefore, while most of these stocks are cheap, I believe that Li Auto, Xpeng, Nio, and Zeekr will remain under pressure in the near term.

More industry news