ZIM Integrated stock’s risky pattern points to more downside

- ZIM Integrated share price has suffered a harsh reversal in the past few days.

- The sharp decline happened after it formed a double-top on the 4H chart.

- The World Container Index (WCI) has jumped sharply recently.

ZIM Integrated (NYSE: ZIM) stock price has suffered a harsh reversal in the past few days, moving into a deep bear market as it fell by over 21% from its highest point this year. It has dropped to $18.80, its lowest point since June 18th. This retreat has brought its market cap to over $2.6 billion.

Shipping fundamentals are improving

Copy link to sectionZIM Integrated stock price jumped sharply in a high-volume environment. Data by Yahoo Finance shows that the company’s volume rose to over 11.34 million, up from over 6.4 million on Friday and 1.78 million on Thursday.

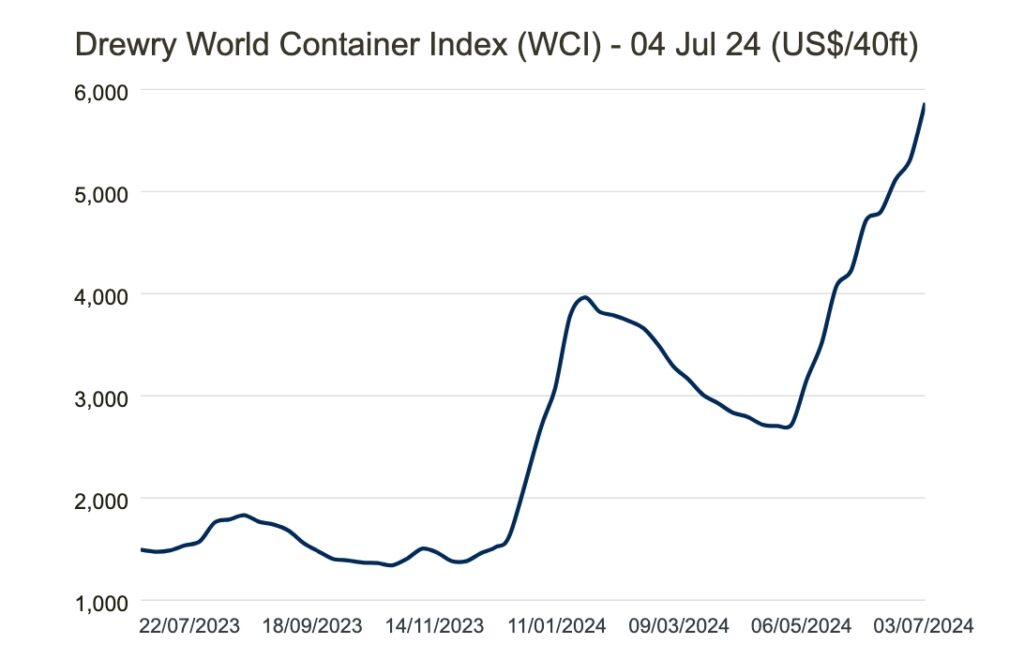

The stock crashed even as the company’s fundamentals improved significantly. Data by Drewry shows that the World Container Index (WCI) to over $5.868, its highest point in years. This is an important level since the price started the year at about $1,380.

World Container Index chart

These numbers mean that the company will continue reporting financial results as it did recently.

The numbers showed that the company carried 846 K-TEUs in the first quarter, higher than the previous 769. Its average freight rate during the quarter stood at $1,452, which helped it to achieve revenues of over $1.5 billion.

Therefore, with the average freight rate soaring to a multi-year high of $5,868, there is a likelihood that the company will continue to do well this year. That means that its financial results will have an adjusted EBITDA of between $1.15 billion and $1.55 billion and EBIT coming in at between zero and $400 million.

These numbers were higher than the previous guidance of between $850 million and $1.45 billion. Therefore, with prices rising and with its fleet modernisation strategy underway, there is a possibility that the company will report stronger results.

The implication is that its dividend trend will continue since ZIM Integrated pays dividend whenever it makes a profit. Its dividend is usually a 30% of its net income.

Global demand could rise

Copy link to sectionThe ZIM Integrated stock price could also benefit from the rising demand as the global economy improves.

A likely catalyst will be interest rate cuts by top central banks like the Federal Reserve, European Central Bank (ECB), and Bank of England (BoE). There are signs that the Fed will start cutting rates in its September meeting while the BoE is expected to start slashing in its July meeting.

The ECB and other central banks like Swiss National Bank (SNB) and Riksbank have started slashing rates. All these factors could have a positive impact on global trade in the coming months, which will help the company.

ZIM Integrated stock price analysis

Copy link to section

The four-hour chart shows that the ZIM share price formed a double-top pattern at $23.77. In most cases, this is one of the most bearish signs in the market, which explains why the stock has dived hard in the past few days. It has also dropped after Citigroup analysts downgraded the stock.

It is now approaching the double top’s neckline at $16.86, which is about 11% below the current level. The stock has dropped below the key support level at $21.62, its highest swing in April 2023.

It has also remained slightly above the 100-hour and 200-hour Exponential Moving Averages (EMA). The MACD indicator has also moved below the neutral point at zero.

Therefore, because of the double-top pattern, the stock will likely continue falling as sellers target the key support level at $16.86. A break below that level will point to more downside as sellers target the key support level at $12, which is about 35% below the current level.

In the longer term, however, the stock will likely continue rising as buyers target the year-to-date high of $23.77.

More industry news