Dear SCHD ETF fanboys, buy COWZ and MOAT too

- The SCHD ETF has done well in 2024 but has trailed the S&P 500.

- SPY and QQQ are the best alternatives to the SCHD ETF.

- COWZ and MOAT are the other alternatives for dividend investors.

The Schwab US Dividend Equity (SCHD) ETF has done well this year as it jumped to its highest level on record. It has jumped by just 2.15%, underperforming the popular SPDR S&P 500 (SPY) and the Invesco QQQ ETF (QQQ) which have soared by over 10%.

Its inflows have jumped to over $55 billion, making it one of the biggest dividend funds in the world. In the past, I have written that, despite its high dividend yield and growth, the generic SPY and QQQ ETFs are better alternatives.

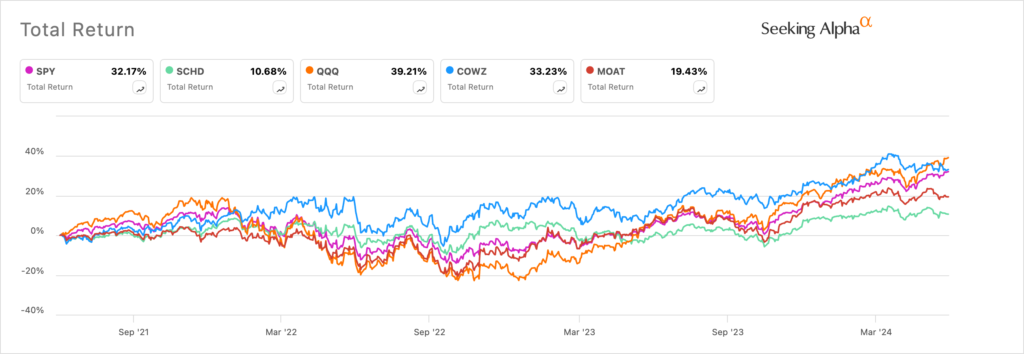

As shown below, the SCHD’s total return in the past five years stood at 74% while the SPY and QQQ have jumped by 100% and 162%, respectively. This article explains why the VanEck Morningstar Wide Moat (MOAT) and the Pacer US Cash Cows 100 ETF (COWZ) are great alternatives.

SPY vs QQQ vs SCHD ETFs

Pacer US Cash Cows 100 ETF (COWZ)

Copy link to sectionThe Pacer US Cash Cows 100 ETF is one of the best alternatives to the SCHD ETF. It is a leading fund with over $23 billion in assets under management and an expense ratio of about 0.49%.

This is one of the best ETFs in the market because of how it is structured. Unlike most other funds, COWZ focuses on companies with growing free cash flows (FCF). FCF is an important metric that looks at all the funds that remains after a company has done everything to grow its asset base. It is calculated by subtracting capital expenditure and operating cash flow.

The ETF starts with the Russell 1,000 index and looks at companies with the highest trailing 12-month free cash flow (FCF). These firms have an average free cash flow yield of about 7.88% and a P/E ratio of 11.7, which is lower than the S&P 500 index multiple of over 20.

By focusing on FCF, energy is the biggest part of the ETF followed by consumer discretionary, healthcare, industrials, and information technology. The biggest companies in the index are the likes of Vistra, HP, Altria, 3M, and Valero Energy.

All these factors have led to strong returns. COWZ has had a total return of 118% in the past five years while the SCHD has returned 74%. SPY and QQQ have returned 100% and 162%, in the same period.

VanEck Wide Moat ETF (MOAT)

Copy link to sectionThe VanEck Wide Moat ETF (MOAT) is also another alternative to the SCHD fund. It is a leading ETF with over $14 billion in assets and an expense ratio of 0.46%.

This fund looks at companies with a wide moat in their industries and those that are difficult to disrupt. Most companies in the ETF are in the healthcare industry followed by industrials, technology, financials, and consumer defensive.

Some of the top companies in the fund are Teradyne, Alphabet, International Flavors & Fragrances, RTX, and Tyler Technologies. All these companies have strong moats that are hard to dethrone. For example, Alphabet dominates the search engine industry while RTX is the biggest company in the defense industry.

SPY vs SCHD vs QQQ vs COWZ vs MOAT

The MOAT ETF has done well over the years. Its total return in the past five years stood at 95% while the SCHD has gained 74%. As shown above, the fund’s total return in the past three years was 19.3%, higher than SCHD’s 10.6%.

Therefore, in addition to the QQQ and SPY, it makes sense to add COWZ and MOAT ETFs, which have a track record of growing their funds.

More industry news